personal-finance

Why are retail investors exiting debt funds?

Oct 28, 03:10

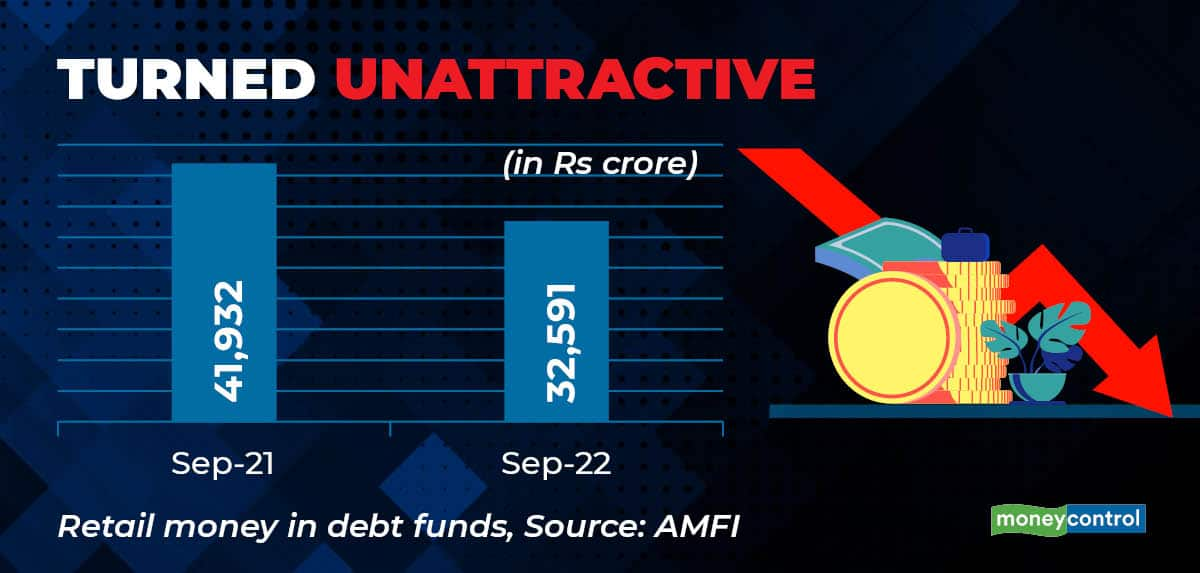

Small investors trimmed their investment in debt funds across categories over the past one year. Industry body AMFI data show that retail money in the open ended debt funds declined by 22% to Rs 32,591 crore as of September 2022. Experts attribute this to investors worrying about the rising yields and its consequences of possible suboptimal returns from the duration funds. Most debt categories struggled to deliver matching return with the bank fixed deposits last year. Secondly, attractive returns from the equity market over the last three to four years drew investors to equity-oriented mutual fund schemes.