personal-finance

Why a loan against FD instead of personal loan?

Sep 14, 06:09

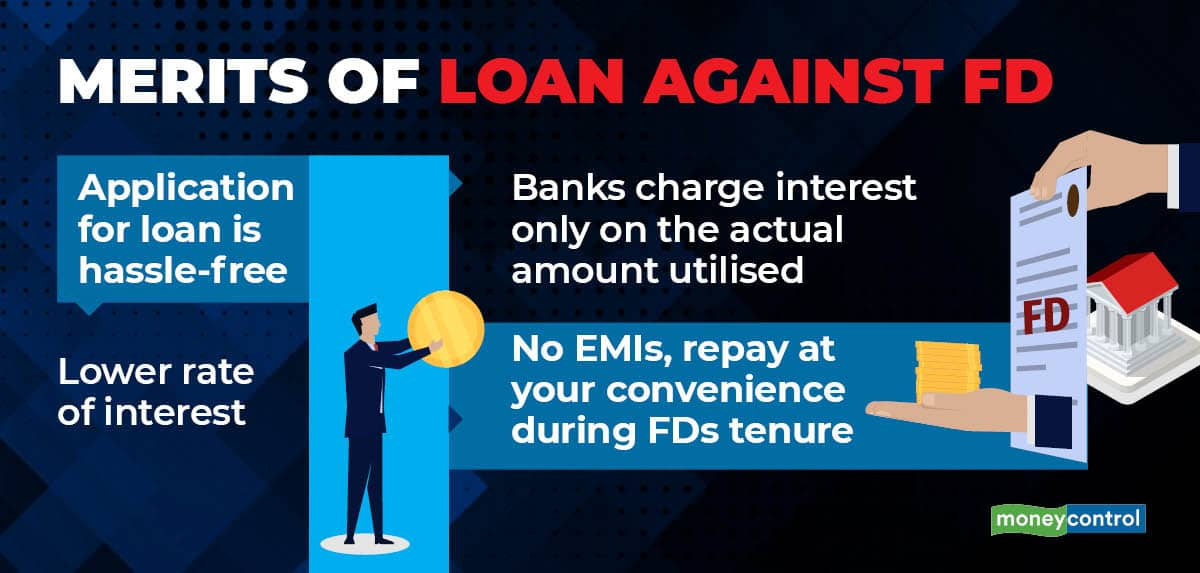

Bank fixed deposits (FDs) help in contingency planning. In an emergency, you can either liquidate the FD or taking a loan against it. With the former, you can erode the wealth. Loan against FD is a better option as you continue to earn interest on the FD and get access to funds. It gives you liquidity of up to 80-85% of the FD value. The interest rate for such a loan is lower than that for an unsecured personal loan, i.e. 2% higher than the interest rate earned on FD, whereas interest rate on personal loan is between 13% and 35%. You also have the flexibility to repay the loan during the investment term.