personal-finance

What makes a good bond investment?

Apr 04, 07:04

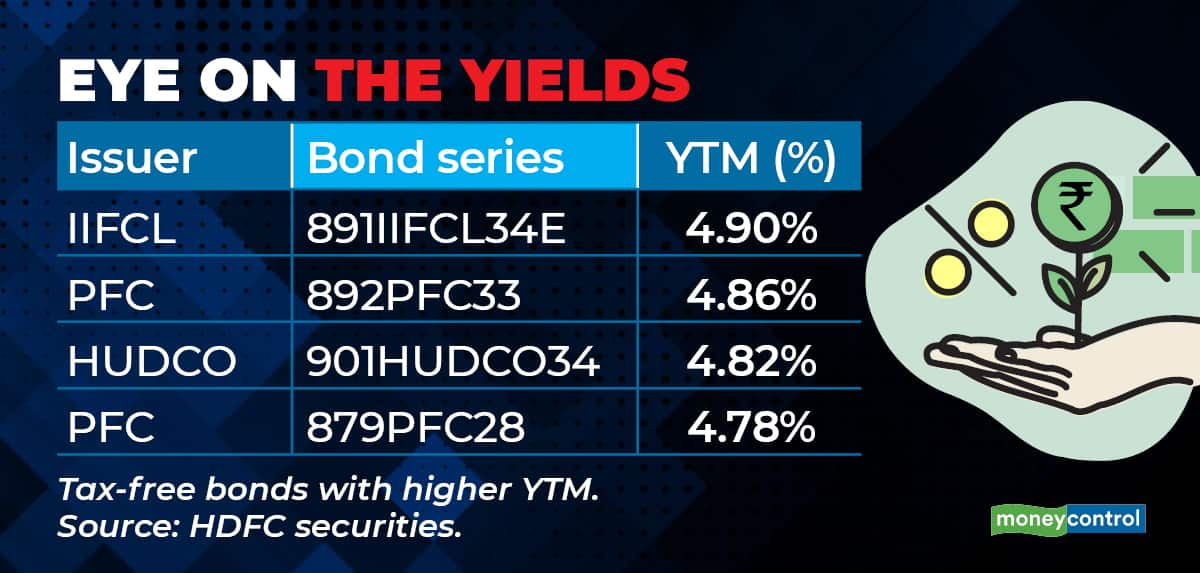

When we buy a bond, we usually look at its interest rate. But when we buy it from an exchange, we must focus on the bond's YTM or Yield to Maturity. That's because we buy them at market price (MP), and not at face value (FV), and MP could be higher or lower than FV. YTM is the indicative rate of return calculated using the prevailing bond price, all future interest income and maturity amount, assuming all are paid on time. This can be calculated using an Excel sheet or by your broker. Pick higher-rated bonds at higher YTMs that have higher traded volumes in the exchanges.