personal-finance

What is external benchmark-linked lending rate?

Nov 16, 02:11

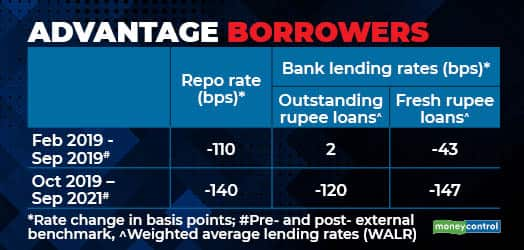

Since October 2019, all banks have had to link their retail floating rate and MSME loans to an external benchmark, as per the Reserve Bank of India's diktat. In case of most banks, it is the repo rate. Unlike earlier benchmarks – Base Rate and Marginal Cost of funds-based Lending Rate (MCLR) – External Benchmark-linked Lending Rate (EBLR) ensures better transmission of policy rate changes. In case of a repo rate cut, banks have to pass on the entire benefit to borrowers. Likewise, borrowers will have to bear the entire burden of any repo rate hike. RBI's Monetary Policy Report (October 2021) points to more effective transmission of policy action under the EBLR regime.