personal-finance

What factors matter in a loan against property?

Dec 06, 04:12

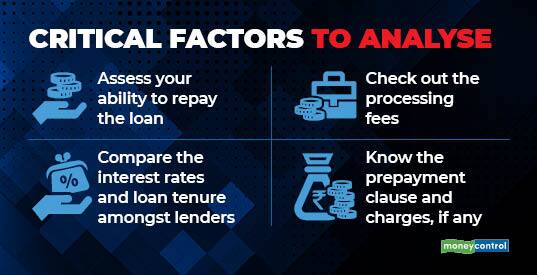

There are unforeseen challenges in the personal or professional life that require ample funds. For instance, medical emergency and business expansion. In such situations, opting for a loan against property (LAP) may be a worthwhile option. LAP represents a secured loan that is given after the prospective borrower pledges her residential or commercial property as collateral. Such collateral must be self-owned, along with a marketable and valid title. While disbursing the LAP amount, a borrower's income, credit history and the property's present value are evaluated. Interest rates offered on LAP range from 8% to 10% p.a., it is lower than a personal loan, since there is a collateral.