personal-finance

What are small-cap mutual funds' favourite stocks?

Jun 28, 12:06

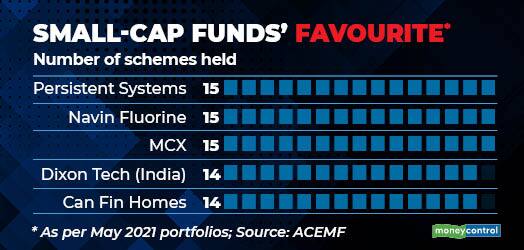

It's a challenging task for small-cap funds to pick stocks. These are stocks ranked 251st and beyond in terms of market capitalisation. They are under-researched and prone to risks. Small-cap stocks are also largely illiquid; it's crucial to buy them in limited quantity. That is one vital reason why small-cap funds are more diversified that large-cap funds. And because the universe of small-cap is very large, there are fewer common holdings between two or more small-cap funds compared with large-cap funds. For instance, ICICI bank and HDFC Bank—the two most popular stocks among MFs—are held by over 400 schemes. Persistent Systems—the most popular small-cap stock—is held by just 15 small-cap schemes.