personal-finance

What are inter-scheme transfers?

Aug 09, 04:08

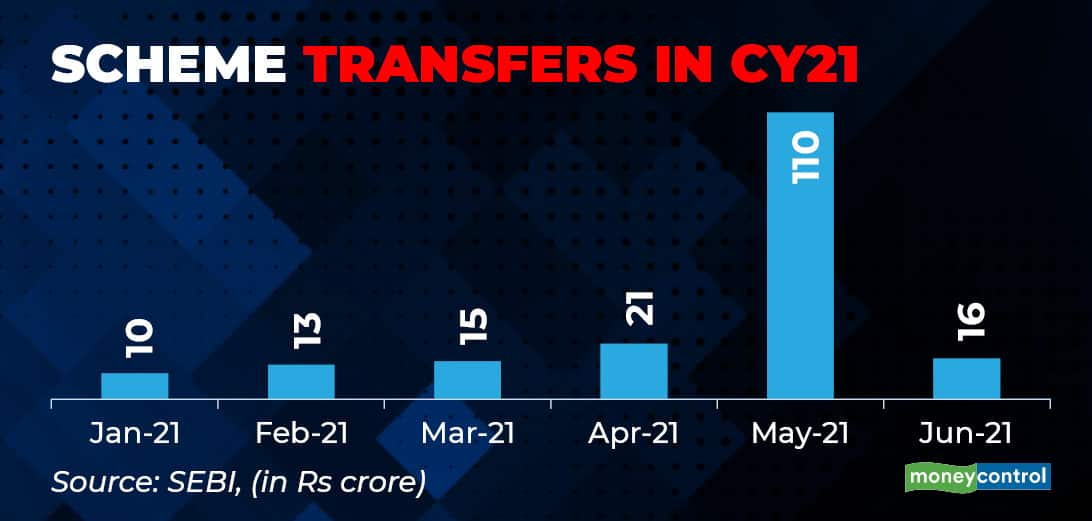

Mutual funds (MFs) have the option of transferring securities from one of their schemes to another. These are inter-scheme transfers (ISTs). Now, ISTs are usually done when the debt scheme is facing heavy investor withdrawals but is unable to sell some of the debt securities in the market to generate funds. Market regulator SEBI doesn't want MFs to rely heavily on ISTs because they can transfer higher credit risk onto other schemes. From this calendar year, SEBI has tightened rules to deter such transfers. Keep track of portfolio disclosures of your scheme, to check if a lower-rated or lesser-known company's debt paper has suddenly entered your scheme.