personal-finance

What are deductibles in insurance policies?

Mar 24, 08:03

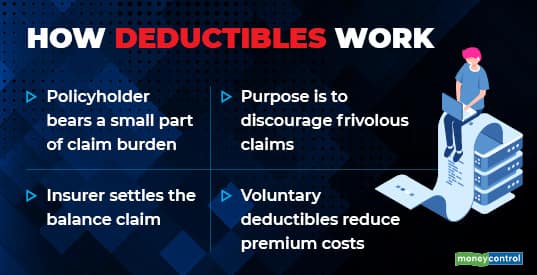

Deductibles refer to the small part of claim burden that policyholders have to bear, before the insurance company settles the claim. The primary objective is to discourage policyholders from filing ‘frivolous' claims. For instance, travel policies come with deductible of, say, $100 on medical expenses. Motor covers mandate deductibles of Rs 1,000-2000 for private cars, but if you opt for higher deductibles, premiums could be 20-30 percent cheaper. In case of health covers, this is prevalent in top-up plans that get activated only after your claim amount breaches a pre-set limit. You can either pay the initial amount out of your pocket or use your base health cover for the purpose.