personal-finance

Should you choose government security over FD?

Jun 30, 03:06

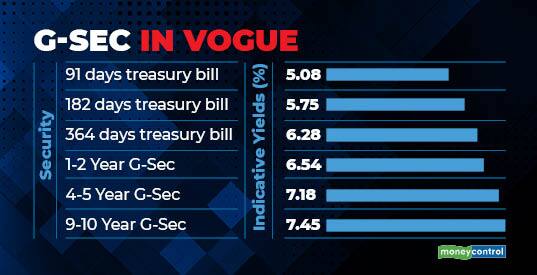

Rising interest rates pushed many individual investors looking for regular income scout for opportunities. However, rates on fixed deposits are yet to go up meaningfully. But the Reserve Bank of India's RBI Retail Direct offers investors some attractive investment avenues.

The platform offers scope to participate in auctions of treasury bills, sovereign gold bonds, government securities and state development loans. These carry little credit risk and offer better rates than comparable traditional bank fixed deposits. The investors can pick and choose the right security depending on their investment time frame. Invest if and only if you can hold it till maturity as interim liquidity is uncertain.