business

How to claim tax benefits on rent without HRA

Jul 28, 06:07

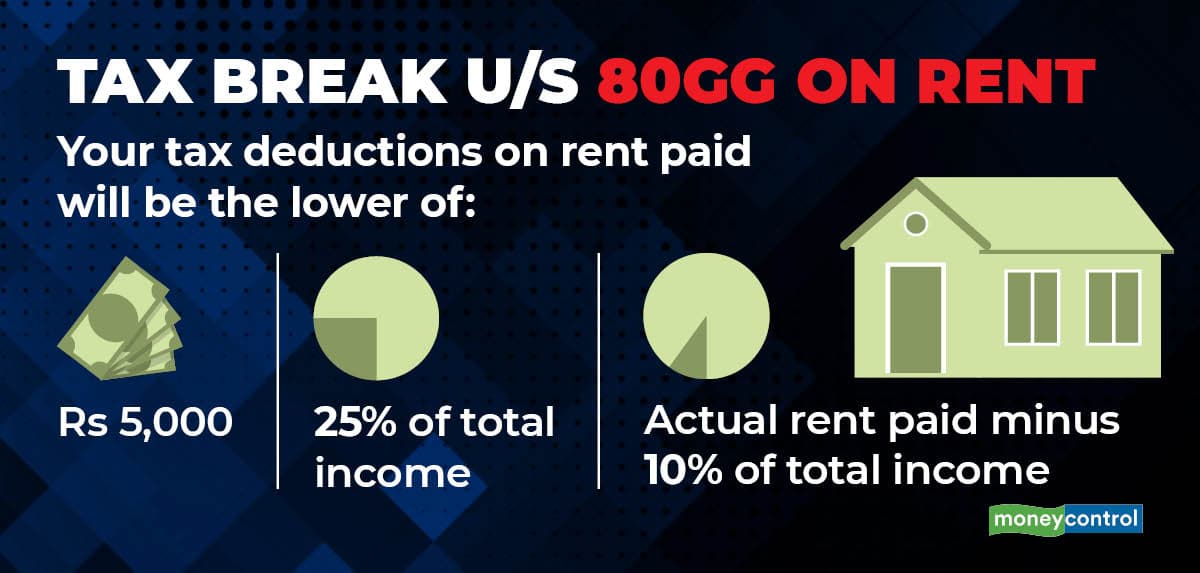

Typically, house rent allowance (HRA) is part of employees' salary package. It is exempt from tax, subject to certain conditions. But, what if your employer does not offer HRA or if you are self-employed? Then, income tax rules offer relief through section 80GG. On rent paid, you can claim deduction of up to Rs 5,000 a month, 25 percent of your total income or actual rent paid minus 10 percent of total income, whichever is lower. However, you will not qualify for this concession if your spouse, minor child or your Hindu Undivided Family (HUF) - in case you are part of one - owns a house in the place where you usually stay.