personal-finance

How to avail home loan-linked tax breaks

Mar 16, 06:03

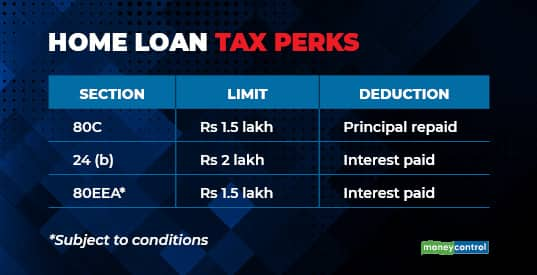

Repaying a home loan is daunting, but the associated tax benefits can offer some comfort. You can claim deduction of up to Rs 1.5 lakh under section 80C on principal repaid as also on processing and other fees paid. Interest paid on the loan taken to buy a house for self-use entitles you to a tax break of up to Rs 2 lakh under section 24(b). If it is a joint loan, a couple can individually claim deductions and exhaust limits under these sections. Additional Rs 1.5 lakh-deduction is offered to first-time home-buyers who might have taken home loans between April 1, 2019 and March 31, 2022, if the property value is under Rs 45 lakh.