personal-finance

How equal-weight index funds benefited last year

Aug 26, 05:08

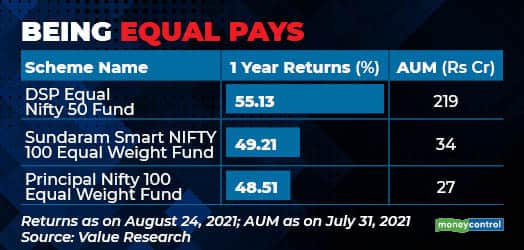

Typically, index funds and exchange-traded funds (ETF) benchmark themselves against the indices that are constructed using market capitalisation (m-cap) method of stocks. But in the last couple of years, there has been an innovation of sorts. Equal weight indices were created. These indices consist of the same stocks that the m-cap indices have, but with a difference —the underlying companies have equal weights. For instance, the Nifty50 equal weight index has allotted a weight of 2% to all its underlying stocks. And the results have come, thanks to a broad-based rally seen in the last year in which many stocks across sectors do well. In such rallies, these funds outperform their parent indices.