personal-finance

How do the new fixed deposit rules affect you?

Jul 06, 03:07

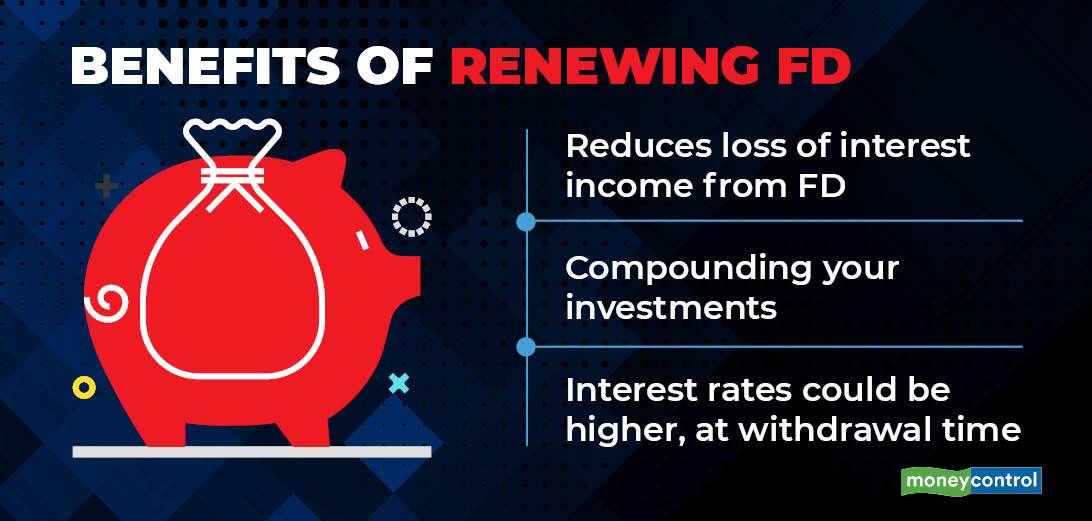

There is a small change in the way your fixed deposit (FD) interest will be calculated. The Reserve Bank of India (RBI) says after an FD matures, if the amount is not claimed by the depositor, interest will be equal to the savings account, or the interest rate on FD, whichever is lower. Earlier, it would have attracted just the savings bank rate. Say, you have a 1-year FD with SBI, at an interest of 5% p.a and the interest on the bank's savings account is 2.7% annually. Assume that neither did you withdraw your money or renew the FD on its maturity. The bank will now calculate the interest rate after maturity, per the savings account rate. It's best to withdraw or renew your FD on maturity.