personal-finance

Have you considered these tax-saving funds?

Mar 28, 07:03

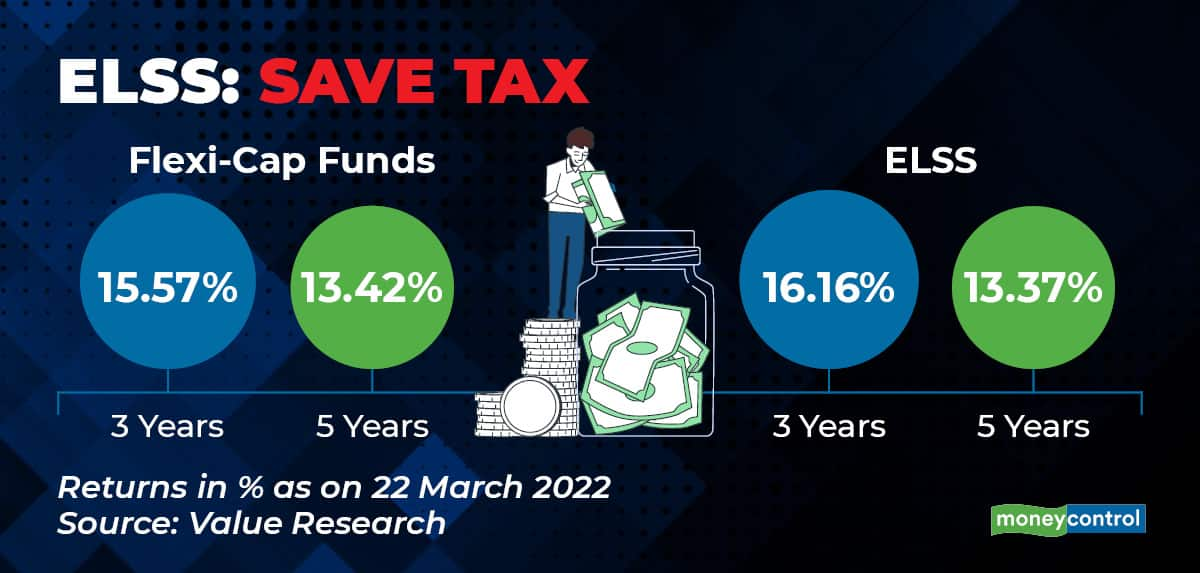

If you have not yet completed your tax-saving investments for the FY2021-2022 and are worried about completing it before the March 31 deadline, tax-saving funds cannot be ignored.

Investments in these schemes up to Rs 1.5 lakh in a financial year can be deducted under section 80C. These schemes invest in shares of companies of all sizes. Given their volatile nature and ability to create wealth in long term, they work for people with a risk appetite. Investments in ELSS (equity linked saving schemes) have a lock in of three years, which helps investors to ride out the volatile phases.