business

Decoded: Tax relief on COVID-19 monetary support

Aug 10, 07:08

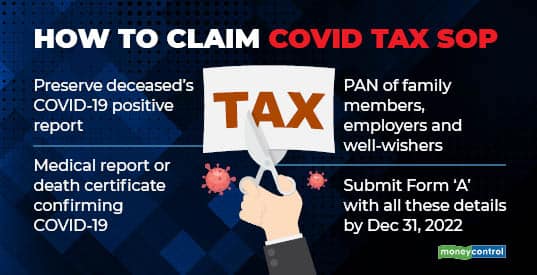

In 2021, the government declared that financial support received by a deceased COVID-19 patient's family would be exempt from tax, subject to conditions. Recently, the I-T department specified the rules for claiming the tax break. It is allowed if she had died within six months from having tested positive. Acquaintances' monetary help is tax-free up to Rs 10 lakh, but there is no limit on employers' financial aid. Families need to preserve positive report or hospital's diagnosis and medical reports or death certificate confirming COVID-19 as the cause. These details, along with PAN, have to be furnished in Form ‘A', which is to be submitted to the I-T department latest by December 31, 2022.