personal-finance

Liquid funds: Beware of exit loads

Mar 31, 06:03

Liquid funds, debt schemes that invest in bonds maturing in less than 91 days, are used extensively by investors keen to park money for very short periods. Some use these as source scheme for starting systematic transfer plans to feed into equity funds. Liquid funds do well in a rising interest rate environment and many investors prefer them over fixed deposits for short term parking.

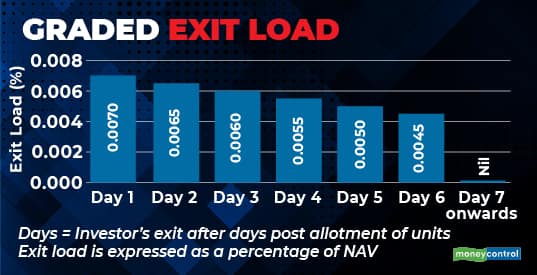

Traditionally these investments never had exit loads. However, in October 2019, SEBI introduced graded exit loads on units of liquid funds. Units held for more than seven days are not subject to exit loads. These exit loads deter hot money from entering liquid funds.