economy

What is an easy money policy?

Aug 25, 01:08

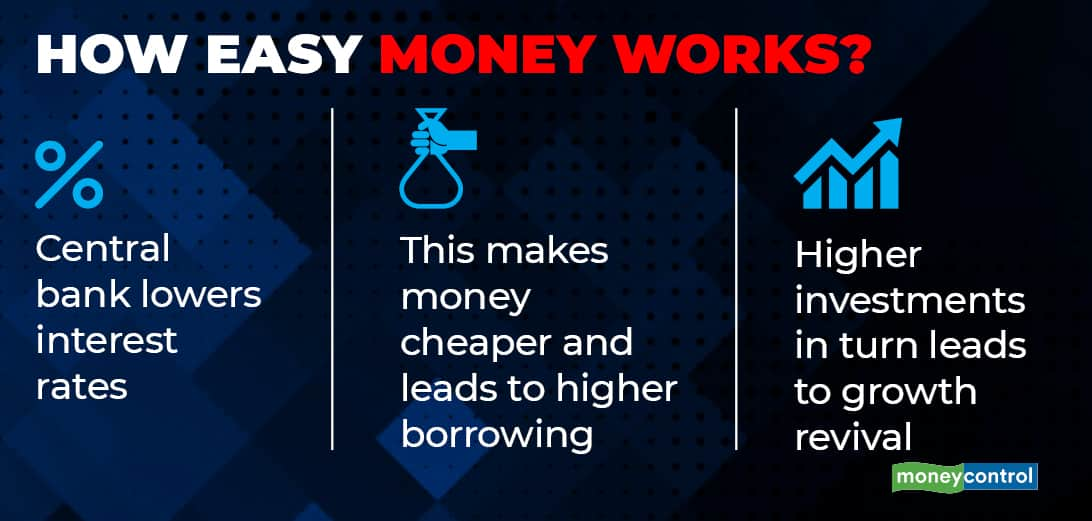

Easy money policy is when a central bank such as the RBI lowers interest rates sharply to make borrowing cheaper in the financial system. The aim is to support growth in the economy. Central banks adopt an easy money regime when growth slows in an economy and fiscal policy alone is deemed inadequate to shoulder the responsibility of revival. An easy money policy, however, leads to inflationary pressures in the financial system because the money supply increases. Hence, at some point, the monetary policy needs to reverse the easy money stance. The Reserve Bank of India is presently embarked on an easy money stance to support a faltering economy battered by the Covid-19 pandemic.