personal-finance

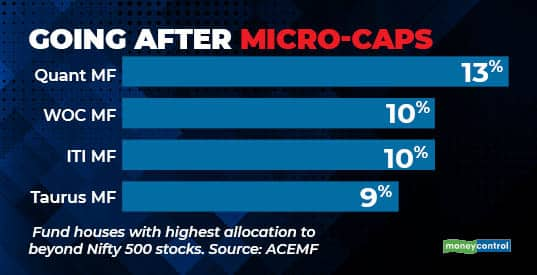

Which fund houses benefited more from microcap rally?

Jan 30, 05:01

While fund managers usually limit themselves to the top 500 companies due to liquidity comfort, they occasionally venture beyond these. ACEMF data shows many mutual funds with small asset base allocated higher to the beyond top 500 stocks. Experts believe that small-sized fund houses that had sizeable allocation into smaller cap stocks benefitted in the small and microcap rally seen in the last few years. They had an edge over the larger size fund houses as the former allocated higher weight to these stocks in their respective portfolio schemes. They benefitted more when those stocks rallied. But will these fund house manage the illiquidity risk? Only time will tell.