India’s current account deficit went up to 1.1 percent of GDP in the April-June quarter from only 0.2 percent of GDP in the previous quarter, i.e., January-March 2023. This 1.1 percent is also higher than most economists’ estimates which ranged between 0.8 percent and 0.9 percent of GDP.

Now CAD at 1.1 percent of GDP is not worrisome at all. But what is troubling is the reason why the deficit has gone up – a fall in services exports! This unexpected fall raises questions about the future growth of India’s services exports and the plentiful jobs this sector has been creating.

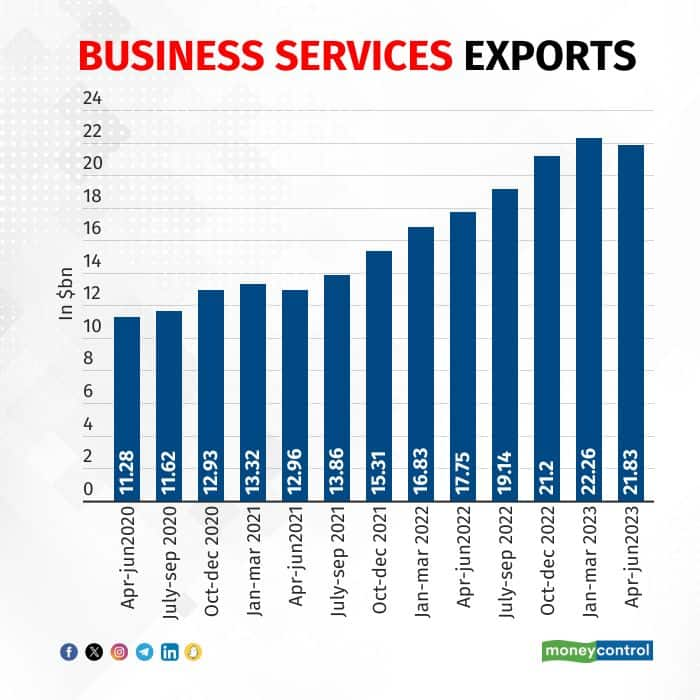

India’s services exports for the longest time have been its software exports. But since Covid, non-software services exports have been growing steadily, rising quarter after quarter for 12 consecutive quarters from April-June 2020 to January-March 2023. But in the April-June quarter of 2023, this export number fell for the first time in 13 quarters.

Business Services Exports

Business Services Exports

This non-software services export has been India’s new-found trump card since Covid. The pandemic taught offices all around the world that most middle office jobs -like audit, compliance, analytics, and even HR can be done from home. And if it can be done remotely from within the US, why not get it done remotely from India at one-tenth the cost or less? This started the tide of Western companies outsourcing their middle office to India. In the first half of 2023, 18 companies including Blackberry, Cockroach Labs, CyberArk, Truecaller, Berry Global, Greenlight and Lloyds Banking Group set up Global capability Centres in India, while other biggies like Citibank, Deutsche, and Natwest, expanded hiring for their GCCs already set up a couple of years ago. Nasscom’s July report said 1580 GCCs have been set up in India employing 1.66 million people. Besides, the big 4- EY, Deloitte, PWC and KPMG - have hired close to 250,000 people to do similar middle-office work for US and British companies. Lesser-known firms in Ahmedabad, Jaipur, Lucknow, Bengaluru, Chennai, Kochi, and Mysuru have also been hiring armies of CAs, auditors, lawyers and such other personnel to do middle-office work for foreign companies. So much so the non-software services exports have doubled from $11 billion in the quarter of June 2020 to $22 billion in the quarter ended March 31.

The expectation was that this is the start of a decadal or multi-decadal trend, as educated Indians could do the work of talent that’s not available or is too limited and costly in the West because of their declining population.

This fall in non-software export earnings in the latest April-June quarter casts the first doubts over this longer-term trend. Of course, it may be a temporary slowdown in the face of rising rates and economic uncertainty in the West but until we see higher numbers in coming quarters, we have to worry not just about export earnings but also job creation.

The second disturbing data point in the April-June BOP (balance of payments) release from the Reserve Bank of India is that private remittances from Indians living abroad to families in India declined for the second consecutive quarter.

Private Transfers

Private Transfers

This is rather disturbing: Remittances sent by Indians living abroad have been an almost one-way street all the way from nineties, when India’s software companies landed on the global coding industry with a bang. Together with software earnings by software companies, this was a comfortable way to finance the current account deficit. That remittances have fallen for two consecutive quarters makes one want to worry if the trend has peaked.

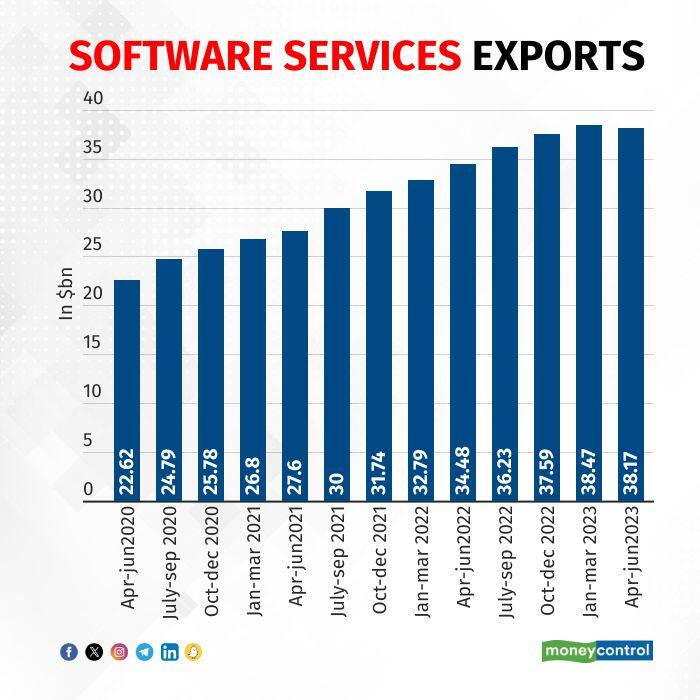

A third item that has led India’s export earnings lower, is the software exports which have declined marginally from the March quarter levels. But this may said to be on expected lines.

Software services exports

Software services exports

Almost all IT companies announced slightly sub par numbers in Q4 of Fy23 due to uncertainty in the destination countries the US and the UK, especially after the fall of SVB Bank.

So while the slight fall in software earnings is par for the course, the fall in remittances and in non-software services exports coming together needs to be watched. If they continue, or even plateau, policy makers need to worry – an easy source of financing the current account deficit may be drying up.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!