Madhuchanda Dey Moneycontrol Research

The Yes Bank stock had a stellar run over the past month, outperforming benchmark indices by quite a margin. So the fall in share price after the bank declared its Q1 FY19 earnings is, prima facie, a thumbs down to the numbers.

But a closer look at the numbers suggests that the bank’s performance was fairly in line, with strong business growth and fee income traction. While the interest margin was a disappointment, the outlook is positive.

If you leave the slightly higher slippage aside, asset quality did now show any signs of stress. The bank is well-capitalised and sees immense opportunity in the marketplace, thanks to the demise of a large section of PSU banks.

We find value in the stock, which is currently trading at 2.7X FY19 book. Yes Bank has a strong earnings growth trajectory and could close the valuation gap with retail focused peers should it get a clean chit from RBI in its next audit.

Strong performance

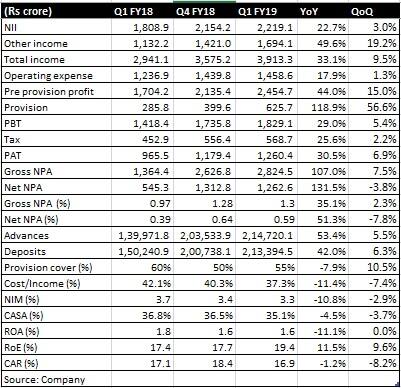

The lender’s profit after tax grew 30.5 percent in Q1 FY19, driven by 22.7 percent growth in net interest income (difference between interest income and interest expenses). NII, in turn, was aided by robust growth in advances and a 40 basis points moderation in margin to 3.3 percent.

Non-interest income grew 49.6 percent (one off components of close to Rs 170 crore). Even if one excludes the one-off bit, the growth was strong on the back of corporate and transaction banking fees.

Yes Bank’s operating expenses grew much slower than its business, because of which its pre-provision profit rose by a healthy 44 percent on year.

The provision line was a bit of a surprise and had several components beyond loan loss provision. Out of the total Rs 379.9 crore of provisions for bad loans, Rs 149 crore was towards increase in provision coverage (gross NPA that carries provision), which now stands at 55.3 percent.

Due to the hardening of bond yields, the bank provided Rs 92.7 crore towards mark-to-market losses and decided to avail of RBI’s dispensation to amortise the remaining Rs 278 crore over the next three quarters of the fiscal year.

In addition, there were Rs 57 crore of general provision, Rs 36 crore of forex revaluation provision and Rs 21 crore on account of country risk pertaining to the bank’s overseas operations.

Business showing strong traction

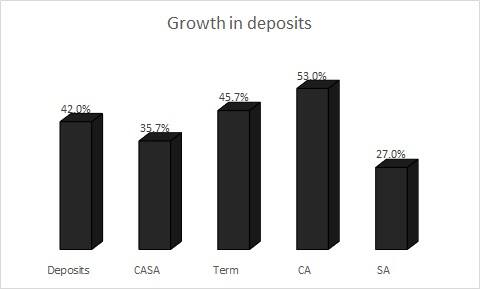

The bank has been aggressive in capturing market share. Its advances rose 53.4 percent on year and deposits rose 42 percent, as at the end of June 2018. The bank’s market share in the advances and deposits markets stood at 2.5 percent and 1.9 percent, respectively, at the end of the quarter under review.

However, Yes Bank’s incremental market share in deposits and advances rose to 7.9 percent and 7.7 percent, respectively, indicating strong gains.

Chasing CASA

Source: Company

Garnering more granular deposits lie at the heart of the bank’s business strategy. While the management acknowledged the challenges in garnering low cost deposits, CASA (current and savings accounts) in recent times, its CASA share is at a respectable 35.1 percent and share of CASA along with retail deposits is close to 57 percent.

This is an area that would warrant improvement, going forward.

De-risking while growing the asset book

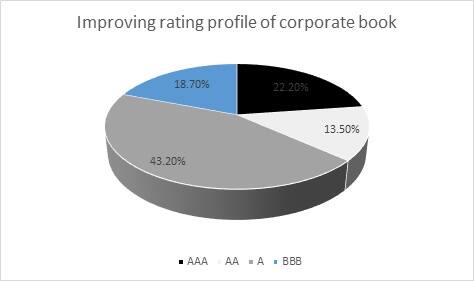

On the asset side, Yes Bank is gradually diversifying and de-risking its book at the same time, while maintaining the growth momentum. While all the four key areas -- corporate, medium enterprises, small and micro, and retail -- have been growing well, retail’s performance is worth mentioning.

The bank is building a high-quality retail book without on-boarding excessive risks. Nevertheless, the retail book has doubled and now forms 14 percent of total advances.

Source: Company

The bank is also working on improving the quality of the book (over 79 percent of the corporate book rated ‘A’ or above) and the reduction in risk-weighted assets as a percentage of total advances stands testimony to the same.

Confident of improving interest margin in FY19

One of the key areas of concern in the earnings report was the reduction in interest margin. The management explained that since bulk of the corporate lending happens at MCLR (marginal cost based lending), it has six-monthly or yearly re-pricing clauses.

Therefore, despite rates hardening, all loans didn’t get re-priced immediately, leading to pressure on margins as deposits got re-priced at a faster clip.

Over the next three quarters, the management expects a 31-basis-points uptick in lending yields due to re-pricing (4 bps in Q2, 11 bps in Q3 and 16 bps in Q4), leading to roughly a 20-25 bps improvement in interest margin.

Asset quality – no visible stress

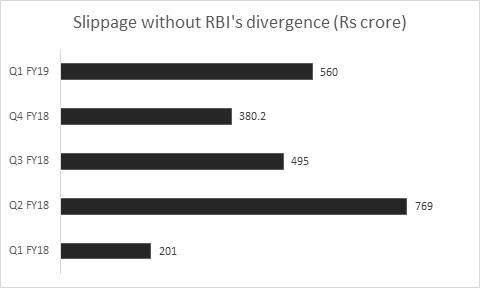

The bank reported a slightly higher gross slippage number, although it expects close to 60 percent of it to be recovered in the near term (cushion of adequate security).

Source: Company

Overall stress – including restructuring and SR (security receipts from sale to asset reconstruction companies) has fallen sequentially to 1.53 percent from 1.72 percent.

Credit cost for FY18 at 76 basis points is expected to fall to 50 basis points in FY19.

However, what could add incremental comfort for investors is a clean chit from RBI in the FY18 audit. But for the time being, the strategy to improve provision cover is a welcome move.

The bank is well-capitalised, steadily capturing market share in advances and is building a solid low-cost liability franchise. It has also guided strong growth in the next couple of years.

With the systemic NPL resolution moving into high gear, we are staring at the end of the bad asset cycle. The void created by PSU lenders is getting captured by smart well-capitalised private banks like Yes Bank.

With several moats that the business enjoys, at 2.7X FY19 book, investors should say yes to a long profitable journey ahead.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!