With more and more people adopting real-time payment mechanism through UPI, India's digital wallet transactions will soon outgrow cash deals, Prime Minister Narendra Modi said.

“Merchants and consumers in India are voluntarily adopting UPI… Experts believe that the digital wallet transaction is going to overtake cash transactions in India soon,” he said.

The prime minister's views came during a YouTube Live session at the launch of the India-Singapore digital payments linkage between UPI and PayNow on Tuesday.

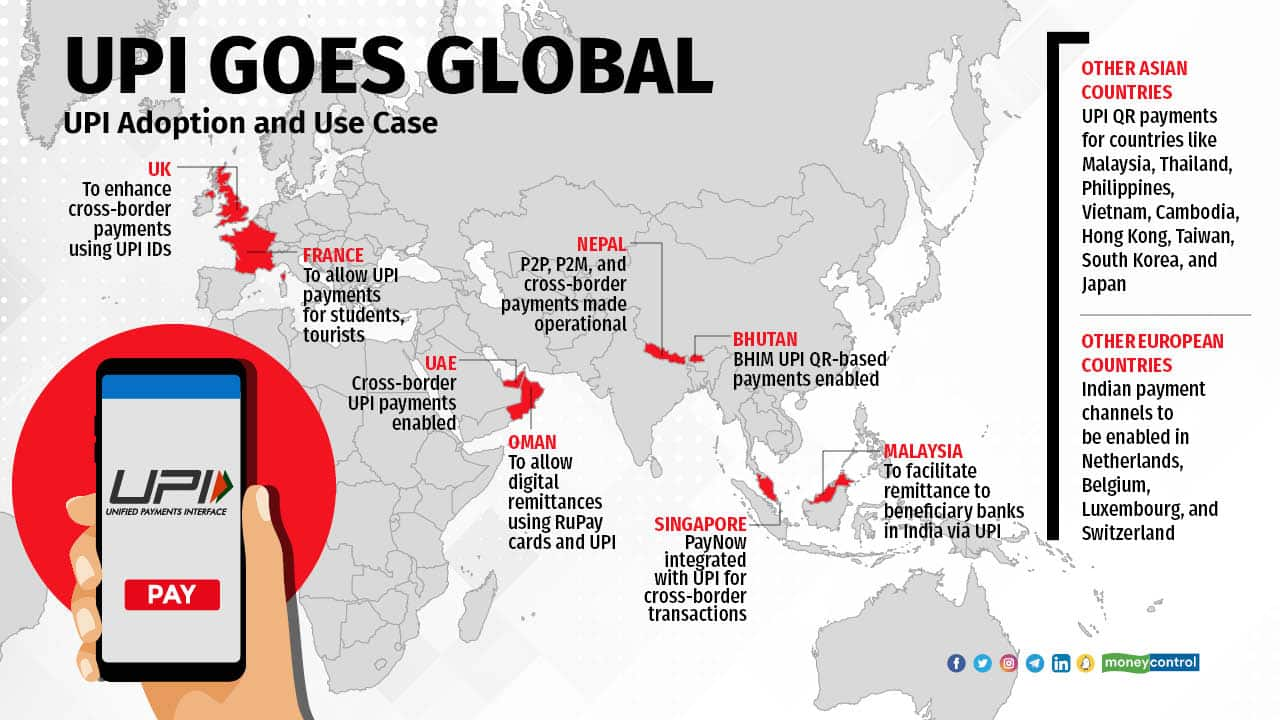

UPI was linked to its equivalent network in Singapore called PayNow in order to enable cross-border remittances between the two countries at a low cost.

“The launch today is the beginning of a new era, a new chapter in cross-border fintech connectivity. From today, the people of Singapore and India will be able to transfer money across the border to each other using their mobile phones,” Modi said.

The linkage was kicked off by Reserve Bank of India Governor Shaktikanta Das and Monetary Authority of Singapore Managing Director Ravi Menon in the presence of PM Modi and his Singapore counterpart Lee Hsien Loong.

“In today’s age, technology connects us in more ways than one and fintech plays a major role in creating that connectivity… The people who will especially benefit from this are migrant workers, professionals, students, and their families,” Modi said.

“Today, the thousands of startups in India are coming out strong in the area of fintech because of this energy that when it comes to real-time digital transactions, India is among the leading nations in the world,” he said.

In 2022, around 74 billion transactions have been transacted at a value of Rs 126 trillion through UPI. In fact, India’s UPI has received a lot of interest globally and is being adopted by other countries as well.

Nepal became the first foreign country to deploy UPI as a payment platform.

NPCI International Payments Ltd (NIPL), the international arm of the National Payment Corporation of India and Royal Monetary Authority (RMA) of Bhutan partnered for enabling and implementing BHIM UPI QR-based payments in Bhutan.

NIPL partnered with Liquid Group, a leading cross-border digital payments provider, to enable UPI QR-based payments acceptance in 10 markets across Northern Asia and Southeast Asia. With this, UPI can be enabled in Singapore, Malaysia, Thailand, Philippines, Vietnam, Cambodia, Hong Kong, Taiwan, South Korea, and Japan.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!