The underperformance in banking shares this year has led to the weightage of financials in the benchmark Nifty index touch a five-year low. The proportionate weight of Banking and Financial Services shares in Nifty is fallen to 33% as per the latest factsheet from National Stock Exchange, as compared to a 38.45% weightage in April 2023. This is a significant fall of 5.45% in the weightage of banking in the index.

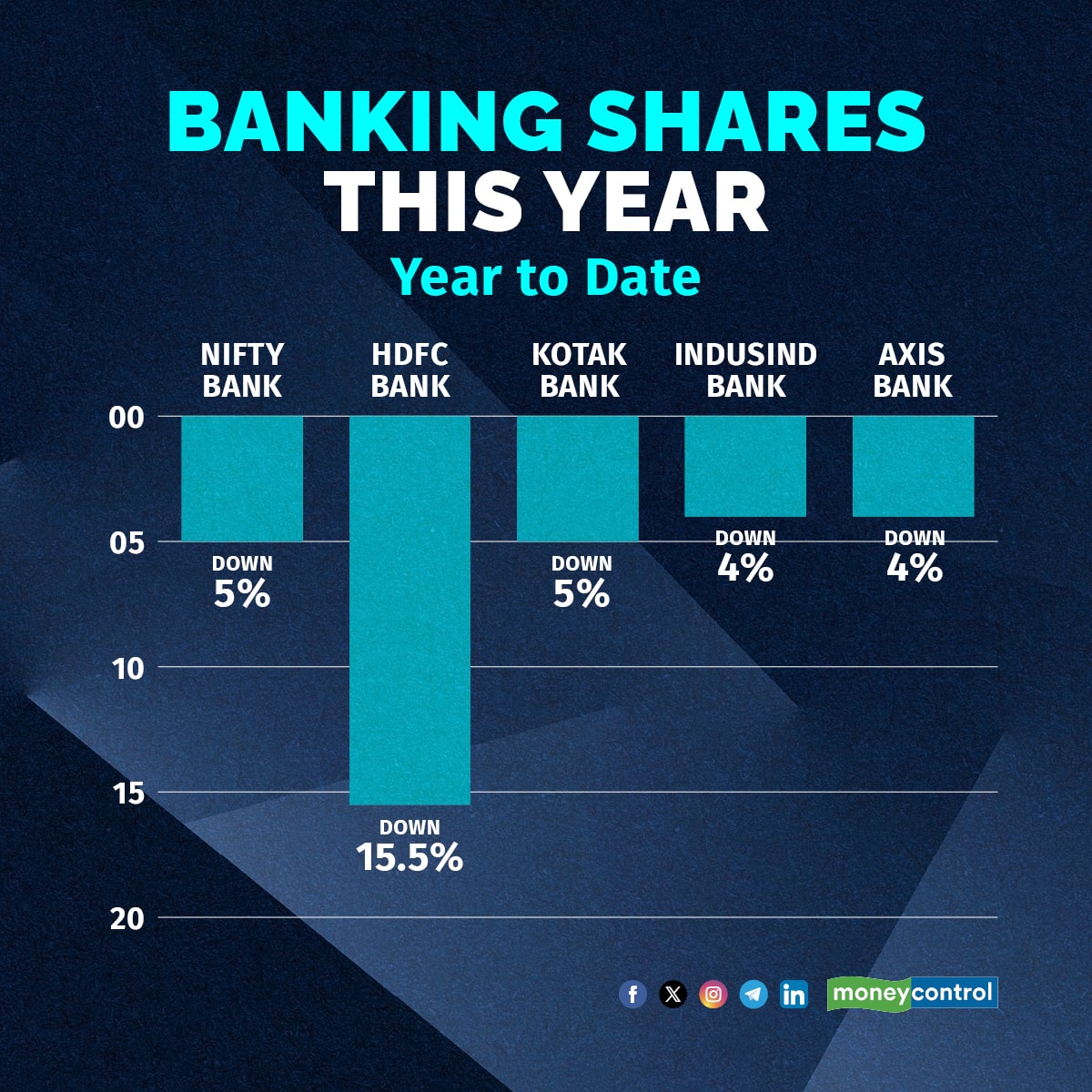

Private sector banking shares are the biggest drag in the weightage, with Nifty heavyweights like HDFC Bank, Kotak Mahindra Bank, Axis Bank and IndusInd Bank all of them correcting sharply in the past few weeks.

Shares of HDFC Bank have taken the biggest knock this year, correcting 15.5% to be the worst performing stock on the Nifty in 2024, after UPL. India's largest private bank had registered its biggest single day drop since March 2020, a day after its Q3FY24 results. The bank had reported a miss in net interest margins (NIM) in Q3FY24 due to higher cost of funds. Higher provisions and decade low earnings per share (EPS) growth also added to the decline.

This weakness in HDFC Bank has rubbed off on the Nifty Bank Index as well, which is down about 5% this year.

In fact, the sentiment for private sector banking shares has soured so much this year that all the constituents of Nifty Bank index except ICICI Bank are trading with losses for the year.

What made matters worse was the third quarter net profit of India's largest lender State Bank of India (SBI) missing street estimates earlier this month, with the bank provisioning for more funds for pension liabilities.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!