Domestic MFs have begun the year 2018 on a positive note. Equity asset under management (AUM) rose for the 14th consecutive month in January to scale a new high of Rs 7.9 trillion, up 2 percent on a month-on-month basis and 58.4 percent on a year-on-year basis.

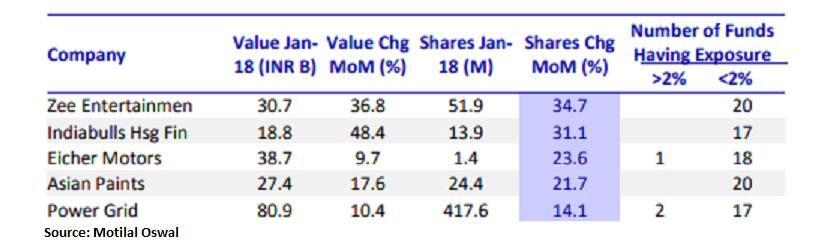

The increase in equity AUM was led by a rise in market indices. Nifty rose by 4.7 percent on a MoM basis while highest net buying on a MoM basis in the month of January was witnessed in Zee Entertainment (up 34.7%), Indiabulls Housing (up 31.1%) and Eicher Motors (up 23.6%), Asian Paints (up 21.7%), and Power Grid (up 14.1%), said a Motilal Oswal report.

In January, MFs showed interest in Private Banks, Technology, Utilities, Capital Goods and Media which saw a MoM increase in weight.

On the other hand, autos, healthcare, metals, telecom, cement, chemicals, and textiles saw a MoM decrease in weight.

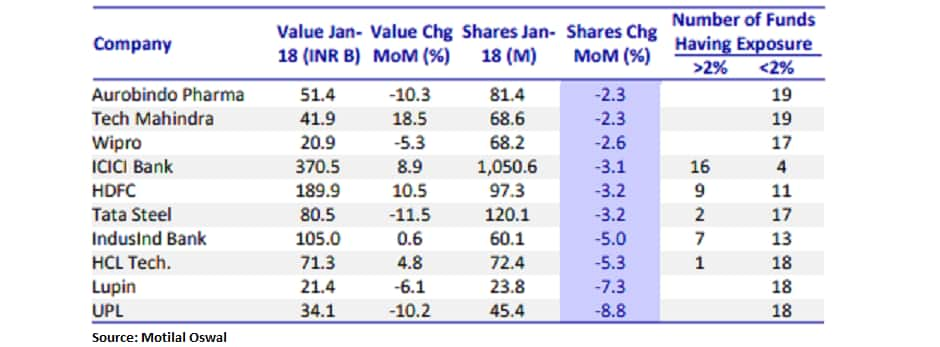

In January, six of the top-10 stocks that saw a maximum change in value was from Financials. HDFC Bank, Infosys, ICICI Bank, L&T and HDFC saw a maximum value change on a MoM basis.

While Bharti Airtel, Tata Steel, Federal Bank, Aurobindo Pharma and Max Financial saw a maximum decline in value, said the report.

The market soon took a U-turn post Budget thanks to the introduction of LTCG as well as weak global cues. Fear of rise in inflation led to fears that the US interest rates is likely to rise more than expected while rising US treasury yields pushed investors to move some money from equities to debt.

Many investors faced deep cuts in their stock portfolio as well as mutual fund portfolio so far in the month of February. The Nifty50 has plunged by about 7 percent from its respective record high recorded in the month of January.

Although redemption has started picking up in the month of January, it will be interesting to see what February month data signals. Redemptions rose sharply by 32 percent on a MoM basis to Rs318 b, leading to a decrease in net inflows (INR154b, -4.3% MoM).

Equity AUM, as a percentage of total AUM, fell 100bp MoM to 35.1% in January. Equity AUM accounts for 5.1% of India’s market capitalization, said the Motilal Oswal report.

Investors are advised to stick to their systematic investment plans (SIPs) and do not indulge in panic selling as the trend still remains to be on the upside.

“You’ll almost never be able to pick inflection points and that shouldn’t be your objective. For those invested with traditional mutual funds and other managers, they should consistently evaluate their managers over 3-yr timeframes,” Piyush Sharma, Co-founder & Portfolio Manager, Metis Capital Management Ltd told Moneycontrol.

“Investors should stay invested if they see competitive performance over such time frames, can identify clarity of thought, and there are no unnecessary strategy shifts. It’s futile to make entry/exit calls on short-term market gyrations,” he said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!