-------------------------------------------------

Seya industries, a vertically integrated benzene-based specialty chemicals company, reported a steady result, which continues to garner attention as it undergoes an expansion plan on a global scale.

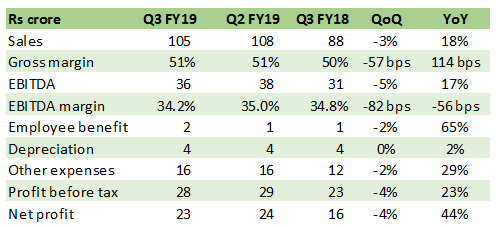

Result analysis Source: CompanyKey positives The company reported a year-on-year sales growth of 18.4 percent, led by better product price realisations. While gross margin slightly improved on a YoY basis, EBITDA margin shrunk on account of higher operating expenses. The company is debottlenecking all product plants by setting up parallel capacities for select products. On account of this, it expects benefits in terms of better operating margin in FY20. Key concerns Prices of key raw material -- benzene -- had declined in Q3 but has picked up in February. It is noteworthy that sharp volatility in raw material pricing has impacted chemical companies adversely in terms of their ability to pass through prices. According to management, it has a transfer pricing mechanism under which 60-70 percent of the contract is based on spot pricing. Other 30 percent of the contract is based on monthly pricing against which it has a secured raw material sourcing. There has been some concern with respect to methanol sourcing in India due to possible Iran sanctions. However, the company has clarified that they are not impacted as they source it from vendors who get their methanol from multiple sources: Iran, Thailand and China. In recent times, methanol spot prices have been quite volatile. Key observationsChina factor: In the chemicals space, the management said some of China's production has resumed post the interim ban of about 15-18 months. It’s is noteworthy that due to China’s ongoing supply-side reforms, many chemical units had shut down for lack of environmental compliance. Recently, some units have started production after appropriate compliance or re-location and in some cases 30-40 percent of earlier supply has resumed. Only one product –- para nitro aniline (PNA) -- of Seya has been impacted. In this case, the supply resumption is 15 percent of what used to prevail earlier. As per management, there has been some impact on pricing, which has now stabilised in the current quarter. Capacity expansion projects on track: The company’s Rs 735 crore mega capacity expansion programme is expected to complete by H2 FY20. Already 72 percent of the site completion has been achieved. The project would lead to more than a six times jump in finished product capacity. Topline contribution from the new capacity is expected to reach Rs 1,000–1,200 crore by FY23 at an optimum utilisation of 80 percent. The company is undergoing a brownfield expansion of its key product, PNA, which contributes about 20 percent of its current revenue (end-market: hair dyes). This expansion would double the capacity to 8,000 tonne of PNA by end of the current fiscal year and hence increased exposure to the hair dyes end-market. Outlook Management guidance (lower end of the range) implies revenue CAGR of 33 percent for the next five years. EBITDA per tonne is expected to moderate due to product mix and normalisation in Chinese production disruptions (worst case: 10-15 percent margin impact) though partially offset by vertical integration benefits. Based on management inputs and our understanding, 25-28 percent could be sustainable operating margin in the long run, which would still be higher than prevailing specialty chemicals sector margins. We remain positive on massive capacity expansion, which is ambitious in scale and comparable to the largest player in the segment like Aarti Industries and hence speaks volumes about the company’s objective to achieve global scale. We remain enthused by the company’s foray into product range, where there has been a high import intensity and serves a strong domestic demand for varied industries. Keeping a conservative assumption of 20 percent utilisation for new capacity in FY21 and assuming that the operating margin moderates to 31 percent, the stock is currently trading at 12/8 times FY20 and FY21 estimated earnings, respectively. While the ambitious capex plan by itself presents an execution risk, project’s progress so far and its debt-to-equity profile (peak expectation of 0.45 times) provides comfort. Follow @anubhavsays

Source: CompanyKey positives The company reported a year-on-year sales growth of 18.4 percent, led by better product price realisations. While gross margin slightly improved on a YoY basis, EBITDA margin shrunk on account of higher operating expenses. The company is debottlenecking all product plants by setting up parallel capacities for select products. On account of this, it expects benefits in terms of better operating margin in FY20. Key concerns Prices of key raw material -- benzene -- had declined in Q3 but has picked up in February. It is noteworthy that sharp volatility in raw material pricing has impacted chemical companies adversely in terms of their ability to pass through prices. According to management, it has a transfer pricing mechanism under which 60-70 percent of the contract is based on spot pricing. Other 30 percent of the contract is based on monthly pricing against which it has a secured raw material sourcing. There has been some concern with respect to methanol sourcing in India due to possible Iran sanctions. However, the company has clarified that they are not impacted as they source it from vendors who get their methanol from multiple sources: Iran, Thailand and China. In recent times, methanol spot prices have been quite volatile. Key observationsChina factor: In the chemicals space, the management said some of China's production has resumed post the interim ban of about 15-18 months. It’s is noteworthy that due to China’s ongoing supply-side reforms, many chemical units had shut down for lack of environmental compliance. Recently, some units have started production after appropriate compliance or re-location and in some cases 30-40 percent of earlier supply has resumed. Only one product –- para nitro aniline (PNA) -- of Seya has been impacted. In this case, the supply resumption is 15 percent of what used to prevail earlier. As per management, there has been some impact on pricing, which has now stabilised in the current quarter. Capacity expansion projects on track: The company’s Rs 735 crore mega capacity expansion programme is expected to complete by H2 FY20. Already 72 percent of the site completion has been achieved. The project would lead to more than a six times jump in finished product capacity. Topline contribution from the new capacity is expected to reach Rs 1,000–1,200 crore by FY23 at an optimum utilisation of 80 percent. The company is undergoing a brownfield expansion of its key product, PNA, which contributes about 20 percent of its current revenue (end-market: hair dyes). This expansion would double the capacity to 8,000 tonne of PNA by end of the current fiscal year and hence increased exposure to the hair dyes end-market. Outlook Management guidance (lower end of the range) implies revenue CAGR of 33 percent for the next five years. EBITDA per tonne is expected to moderate due to product mix and normalisation in Chinese production disruptions (worst case: 10-15 percent margin impact) though partially offset by vertical integration benefits. Based on management inputs and our understanding, 25-28 percent could be sustainable operating margin in the long run, which would still be higher than prevailing specialty chemicals sector margins. We remain positive on massive capacity expansion, which is ambitious in scale and comparable to the largest player in the segment like Aarti Industries and hence speaks volumes about the company’s objective to achieve global scale. We remain enthused by the company’s foray into product range, where there has been a high import intensity and serves a strong domestic demand for varied industries. Keeping a conservative assumption of 20 percent utilisation for new capacity in FY21 and assuming that the operating margin moderates to 31 percent, the stock is currently trading at 12/8 times FY20 and FY21 estimated earnings, respectively. While the ambitious capex plan by itself presents an execution risk, project’s progress so far and its debt-to-equity profile (peak expectation of 0.45 times) provides comfort. Follow @anubhavsaysFor more research articles, visit our Moneycontrol Research page

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed hereDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!