Despite trading at a premium to peers, Goldman Sachs is upbeat on Bandhan Bank. It has cited reasons such as best operating metrics and strong capital base to cushion against asset quality issues, among others, as a justification for the same.

The global research firm has initiated coverage on the stock with a buy rating and a target of Rs 650 per share, an upside of 29 percent.

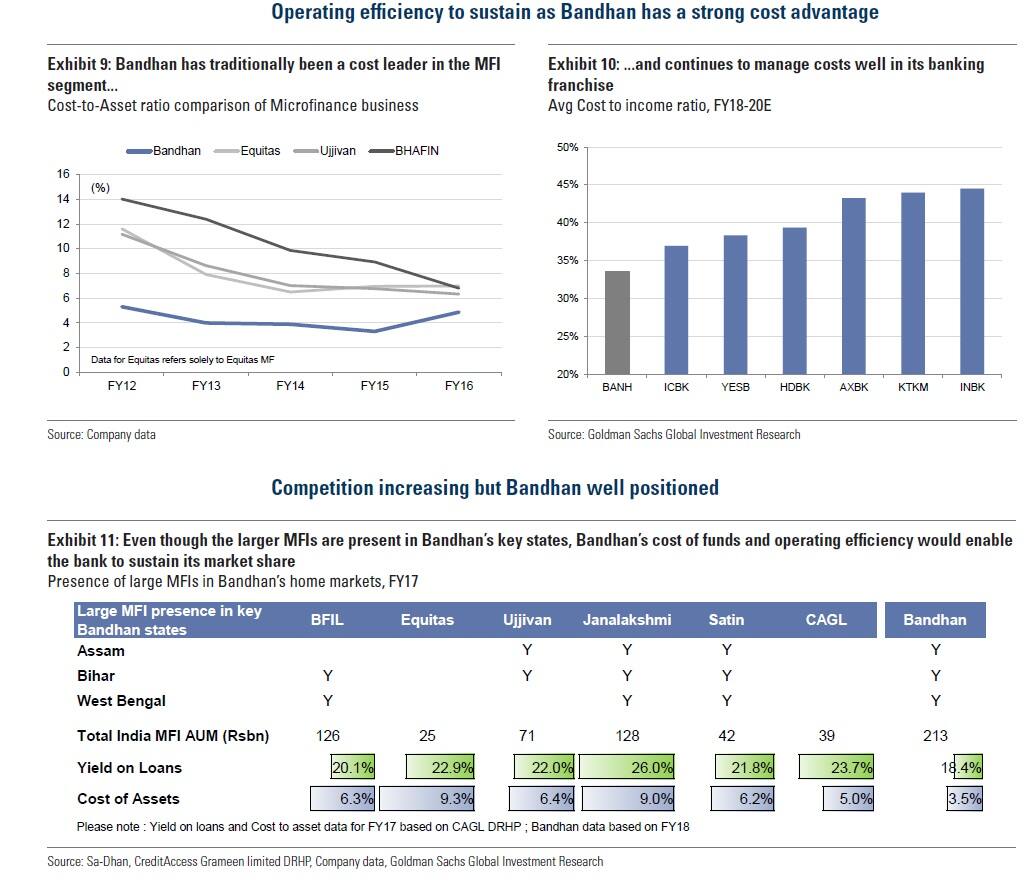

The brokerage expects earnings to grow at 34 percent compound annual growth rate (CAGR) over FY18-23 due to strong lending growth and better profitability. "This is possible due to sustaining market share gains from existing/new geographies in lending and low-cost deposits, diversifying revenue streams with product suite expansion, maintaining competitive edge on industry-leading operating efficiency and better risk-profile on geographical/product diversification."

Also Read: Bandhan Bank: Richly valued but an attractive buy on dipsOn the valuation front, it sees the stock trading at a premium to peers (29.6 times/21.4 times FY19e/FY20e EPS and 5.3 times/4.4 times FY19e/FY20e book value of equity per share, respectively).

It cites: 1) A play on the under-penetration in the micro-finance space. The bank is strongly positioned against its competitors; 2) One of the best operating metrics and profitability ratios (return on assets/return on risk-weighted assets) providing a cushion against any regional issues impacting asset quality; 3) Consistent improvement in reported return on equity as leverage moves higher; 4) Impeccable asset quality track record and early success in the banking business through a strong build out of liability franchise; and 5) Investors’ preference for retail plays on better visibility of earnings growth, liability profile providing funding stability and moat in the form of strong brand and franchise which reflects in its premium valuation.

However, the brokerage cites a few risks. These include asset quality deterioration, key man risks, strategy execution and no extension of timeline for dilution of promoters’ stake.

Since its listing on March 27, the stock has gained over seven percent. In the past three days, it has risen almost four percent.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.