Indian equities witnessed a sharp correction for the week ended November 26 with Nifty breaching 17,000 mark as the new covid variant rattled investors. Rising coronavirus cases in the west, inflation worries across the globe and continued FII’s selling also added to the selling pressure.

Last week, BSE Sensex cracked 2,528.86 points (4.24 percent) to close at 57,107.15, while the Nifty50 dropped 738.3 points (4.15 percent) to settle at 17,026.5 levels.

In the November series, the Nifty retreated 1.79 percent, while the Sensex dropped 2 percent.

Among sectors, BSE Auto index slipped 8 percent, Realty index fell 6.8 percent, while healthcare and telecom indices ended in the green.

The broader indices - BSE Midcap and Smallcap shed 4 percent and 2.5 percent, respectively, in the last week.

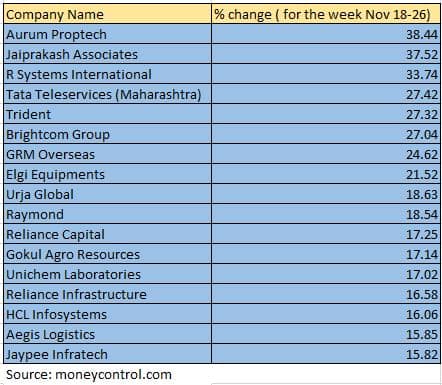

However, last week 41 smallcaps including Aurum Proptech, Jaiprakash Associates, R Systems International, Tata Teleservices (Maharashtra), Trident, Brightcom Group, GRM Overseas, Elgi Equipments and Urja Global, gained over 10 percent each.

On the other hand, 17 smallcaps shed 10-17 percent including PVR, Lemon Tree Hotels, 63 Moons Technologies, Sequent Scientific, Godawari Power & Ispat, Force Motors, Bodal Chemicals, Monte Carlo Fashions and Shoppers Stop.

"Markets saw sharp correction this week amid renewed concerns pertaining to COVID-19. BSE Sensex and Nifty declined close to 4% this week and are down by ~8% from their highs," said Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities.

"Correction in the market was broad-based with BSE Midcap and BSE Smallcap index also witnessing a decline. Amongst sectors, the BSE Auto index was a major underperformer having declined more than 7% this week," he added. "BSE Realty, BSE Bankex, and BSE Capital goods index were other underperformers, declining in excess of 4% during the week. Despite weakness in the equity markets, the BSE Pharma index saw positive returns."

"The new variant of COVID-19 is presenting challenges in the form of lockdowns and travel bans. Apart from COVID-19 related concerns, inflation remains a worry for countries across the globe."

"FII’s have been net sellers this week. Equity markets in the near term will closely follow the impact of new COVID-19 variant, inflation data, and Central Bank policies," Chouhan added.

Among the midcaps, 25 stocks lost between 5-11 percent including Mahindra & Mahindra Financial Services, Honeywell Automation, JSW Energy, Glenmark Pharma, while Apollo Hospitals Enterprises, Rajesh Exports and Biocon up 5-20 percent.

In the last week, the BSE 500 index declined 4 percent dragged by PVR, Interglobe Aviation, Lemon Tree Hotels, Indian Hotels Company, Cholamandalam Investment, Sequent Scientific, Maruti Suzuki India and Force Motors.

"Our markets started trading for this week on a negative note with a sharp sell off on Monday, and post some consolidation in mid-week the index continued the corrective phase on the last session to end tad above 17000 with a weekly cut of over 4 percent," said Ruchit Jain, Trading Strategist, 5paisa.com.

"At the start of the week itself, the index breached its important support and hence we have been cautious post the breakdown of the Head and Shoulders pattern neckline. The mid-week pullback from the support of 17200 did not witness any broad market participation and was led only by the index heavyweight Reliance Industries on the expiry day."

"The new variant of COVID-19 in South Africa and rising cases in certain parts of the world led to nervousness in the Asian markets on Friday. In line with this, our markets too witnessed a sharp sell-off and tested the 17000 mark," he added.

Where is Nifty50 headed?

Gaurav Ratnaparkhi, Head of Technical Research, Sharekhan by BNP Paribas:

On the way down, the Nifty breached lower end of a falling channel as well as the swing low of 17216. As a result, the Nifty has dipped into the crucial support zone of 17200-17000. In terms of the Fibonacci retracement, the Nifty has retraced 50% of the July – Oct rally.

There is potential for a recovery from this support zone as long as the index holds on to 17000 mark on a closing basis. On the other hand, breach of 17000 on a closing basis will allow the Nifty to slide towards the 61.8% retracement mark, which is near 16700.

Yesha Shah, Head of Equity Research, Samco Securities:

Post Q2 result season, Dalal Street will look towards macros for hints to move the needle in broader markets. Inflation being a key factor will be at the centre of all news in the next two weeks since the RBI MPC meet is scheduled in December.

Further, a slew of listing flops in IPOs in the coming weeks could also indicate the slow drying up of liquidity from the markets in general. November monthly auto sales number can be a trigger to drive some movement in the coming week.

Ajit Mishra, VP - Research, Religare Broking:

Though the COVID-19 is not new to the market, the reaction is largely in response to the news of a different variant while the US and Europe are already struggling. The way markets have closed on Friday, we expect more pain in the coming sessions.

Apart from the global COVID-19-related update, markets will also be eyeing the domestic data like auto sales, GDP numbers, etc for cues. Since Nifty has slipped below the critical support zone of 17,150, the next crucial support comes at 16,700. Traders should continue with the bearish bias and use the bounce to create shorts.

Investors, on the other hand, should see this as an opportunity and start accumulating quality stocks in a staggered manner.

Parth Nyati, Founder, Tradingo:

Nifty is continuing its southward journey following the breakdown of a bearish head and shoulder formation and it has also slipped below its critical support of 100-DMA of 17088 with bearish marubozu candlestick formation that has opened the door for further weakness towards 16700/16400 levels.

On the upside, now 17100 will act as an immediate hurdle while 17350-17400 will be the next critical resistance zone.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!