With markets on a roll, investors are looking beyond frontline stocks to unearth value.

Amid the frenzy, Nandan Denim Limited (NDL), a little-known textile midcap, has lately caught the Street's fancy.

The company is India's largest denim manufacturer. Having completed its capacity expansion and backward integration, NDL looks set to garner market share in the post-GST regime as unorganized players grapple with the reality of new taxes.

Denim fabric, which contributes 80-90 percent to NDL's annual turnover on an average, is the company's forte.

Here's a look at the key tailwinds that make the stock fundamentally robust.

Denim fabric capacity expansion: NDL’s fabric manufacturing capacity, which stood at 99 million metres per annum (mmpa) at the start of FY17, increased to 110 mmpa in December 2016, post expansion. Going forward, emphasis will be laid on fashion denim fabric to target better realizations compared to regular denim material. A combination of higher sales volumes and value added products is likely to fuel top-line growth in the coming fiscals.

Backward integration completion: NDL more than doubled its spinning capacity from 64 tonnes per day (TPD) in FY16 to 141 TPD by the end of FY17. This will ensure adequate availability of yarn for the company’s fabric manufacturing unit, besides reducing the degree of dependence on outside suppliers for raw material and facilitating margin accretion.

Foray into premium shirting fabric: NDL’s shirting fabric facility (annual capacity of 10 mmpa), which handled manufacturing of grey shirting fabric until now, has been equipped to manufacture superior variants. The average selling price per metre of the new fabric type is 60-400 percent higher vis-a-vis grey shirting fabric, which was previously sold at around Rs 100 per metre.

Simultaneously, a new yarn dyeing plant was commissioned during the recently concluded fiscal to meet input requirements of the shirting fabric department. The costlier dyed yarn (in comparison to non-dyed) would consequently help the company to command a premium pricing on its shirting material, eventually causing margins to go up.

GST benefits: Post GST implementation, a large number of unorganised manufacturers, by virtue of falling under the tax ambit, will end up losing a significant degree of the competitive edge that they enjoyed over their tax-compliant counterparts over the years. Moreover, GST rate on cotton, the key raw material for NDL, is at par with the pre-GST tax scenario, thereby keeping input procurement costs stable.

Growing fabric demand: India’s denim market is clocking a consistent CAGR of 15-18 percent per annum and is expected to register a retail value of $361 billion by 2020 from the current level of $177 billion. Versatility of denim fabric, presence of numerous denim varieties across the country at different price points, better fashion consciousness, booming e-commerce retailing channels, higher disposable incomes, and geography-agnostic use are some of the other major industry drivers that NDL could possibly capitalize on.

Indian denim manufacturers gaining traction globally: Internationally, the denim industry is expected to grow at a CAGR of over 6.5 percent till 2020, with Latin America and Asia being the front-runners in the premium and super premium segments. Of late, China, India’s biggest rival in the textile space, has been losing its export advantage, particularly to Indian entities, because of higher labour and compliance costs, in addition to declining cotton output (on account of increasing attention towards other cash crops). Evidently, a huge market awaits India’s denim products.

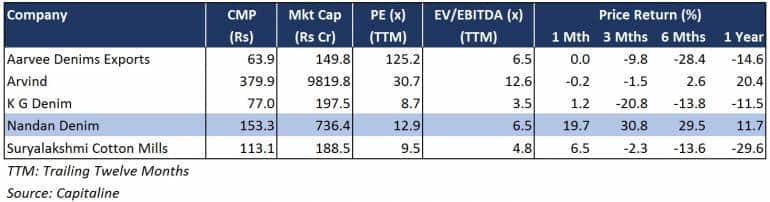

Peer Comparison

FY17 was a challenging year for NDL on many fronts. While a surge in cotton prices led to margin compression, the company’s top-line suffered a setback in the immediate aftermath of demonetisation, too. The expanded capacity didn’t yield revenues in the first nine months of the year.

With cotton prices now stabilizing (owing to an upswing in acreage pan-India) and capacity additions over, the company can look forward to gaining some momentum in earnings.

Nonetheless, though NDL is gradually steering the business towards the value added denim category, unfavourable cyclical fluctuations associated with commoditized denim (that occupies a sizeable share of the company’s product portfolio) could impact margins.

Stiff competition from organised players in the fashion denim business may lead to a loss in market share for the company, thus necessitating constant innovation in terms of styling and design.

However, with most of the challenges largely behind, the stock valuation, at 8.7x FY19 estimated earnings, provides a very interesting accumulation opportunity for the investors.

Follow @krishnakarwa152Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.