Infosys continued to languish at the bottom half of analysts’ wishlists in September as cuts in discretionary tech spends and delays in decision making due to recessionary headwinds in the West sapped appetite for the stock.

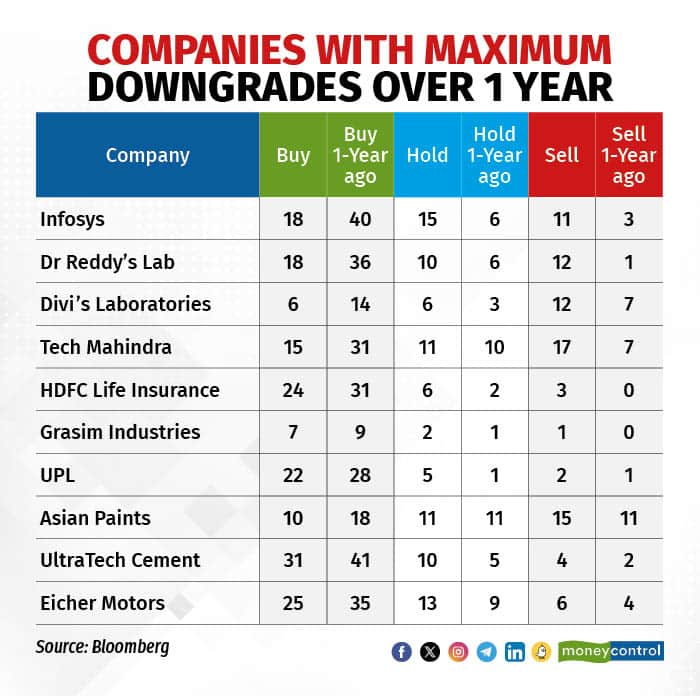

The Bengaluru-headquartered firm, once the bellwether of the Indian IT industry, topped the list of companies which saw the most downgrades over the past year, as per Moneycontrol’s Analyst Call Tracker for September 2023.

With 18 ‘buy’, 15 ‘hold’ and 11 ‘sell’ ratings, it also features among companies with the most pessimism score, which we define as the percentage of sell-side analysts who have a “hold” or “sell” call.

While most IT firms had a sombre start to the FY24 earnings season, Infosys shocked the Street by sharply cutting its revenue growth guidance (on constant currency basis) for the fiscal year to just 1-3.5 percent from 4-7 percent.

For context, Infosys had given a revenue growth guidance of 14 – 16 percent in FY23.

Analyst Call Tracker | Banking, capex-driven plays surface as Street’s choice for SeptemberThe aftershocks of its Q1 show continued to be felt in September as well, going by the analyst commentary.

The IT industry is bearing the brunt of an uncertain demand environment due to economic growth concerns in the US and Europe – the bread-and-butter markets for domestic IT services firms.

Additionally, weakness in industry verticals like banking, retail and manufacturing spells trouble for companies which derive a large chunk of their topline from these segments.

For the year ended March 2023, the US and Europe contributed 61.4 percent and 25.2 percent to Infosys’ total revenue. Segment-wise, BFSI contributed 31.3 percent of revenue, while retail and communications accounted for 14.3 percent and 12.8 percent, respectively.

“From a near-term perspective, we believe global uncertainties and economic slowdown may impact the automation spend and result in delays in investment decisions in North America from where the company earns its majority of the revenue,” Axis Securities said in a recent report.

Problems galoreAnalysts at JPMorgan said the lowered revenue guidance is “realistic” given the uncertain macro environment and the fact that paused projects may have limited visibility of restarting coupled with low signs of demand recovery over the next 6-9 months.

“Infosys has lost predictability, growth leadership and margin stability and witnessed diluted cash conversion in addition to loss of senior management muscle to competition,” they added.

Many analysts have flagged the management-level attrition at Infosys as a major cause for concern.

Infosys Executive Vice President and former head of human resources Richard Lobo resigned from the company in August.

This came following the exits of two presidents — Mohit Joshi and Ravi Kumar S — both of whom were future CEO candidates who resigned from the company within a six month span. Both have gone on to become CEOs of Infosys’ rivals: Ravi Kumar S as the CEO of Cognizant, and Mohit Joshi as the incoming CEO of Tech Mahindra where he takes charge in December.

When asked about top-level exits at the company after the company presented its results for the first quarter of FY24, CEO Parekh said the company has rolled out a new leadership structure within the company.

“We have the great fortune of having incredible leadership talent within the company. And each of them, several of them are stepping up into new roles, driving the growth of this business,” he said.

Analyst Call Tracker | In a sea of ‘buys,’ this brokerage has a ‘sell’ call on NTPCIn a recent note, Kotak Institutional Equities said that the company does have bench strength. “At the same time, we also recognize that it takes time for new leaders to settle into the roles. Further, senior leaders that departed recently may tap in to the Infosys talent pool. We do expect some transient impact although it is difficult to quantify,” the note read.

Silver LiningTo be fair, it is not all gloom-and-doom for the company.

Even in a mostly forgettable Q1, its total contract value (TCV) stood strong with eight quarter-high deal wins at USD 2.3 billion.

“The company's pipeline looks promising… with strong large deals and a continued presence of mega deals and 80 generative AI projects. Clients have responded positively to their AI and generative AI platform. Internal development features open-source generative AI tools for various applications,” analysts at Arihant Capital said.

The company's infrastructure, cloud, and OEM services have promising deal pipelines, indicating a positive growth outlook. Despite the setback of the guidance cut, the long-term demand for IT services remains strong, and once the macro environment stabilizes, there is potential for a significant bounce-back for IT services companies like Infosys, they added.

With the Q2 earnings season set to begin, many analysts expect largecap IT firms to continue their deal win momentum, though the overall numbers are likely to be muted.

“Companies such as TCS, Infosys and HCL have recently reported many large and long[1]term deals…and also mentioned that clients are still continuing their long-term transformation journeys through re-investing the cost saved from the cost optimisation deals. This increase in number of long-term deals further cemented our belief that long-term growth of India IT industry is still intact with a blip of year (FY24) on the back of weak/uncertain macro,” B&K Securities said.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.