India's online gaming industry witnessed record investment in the first nine months of 2021, on the back of surging popularity of mobile games during the pandemic, according to a new report.

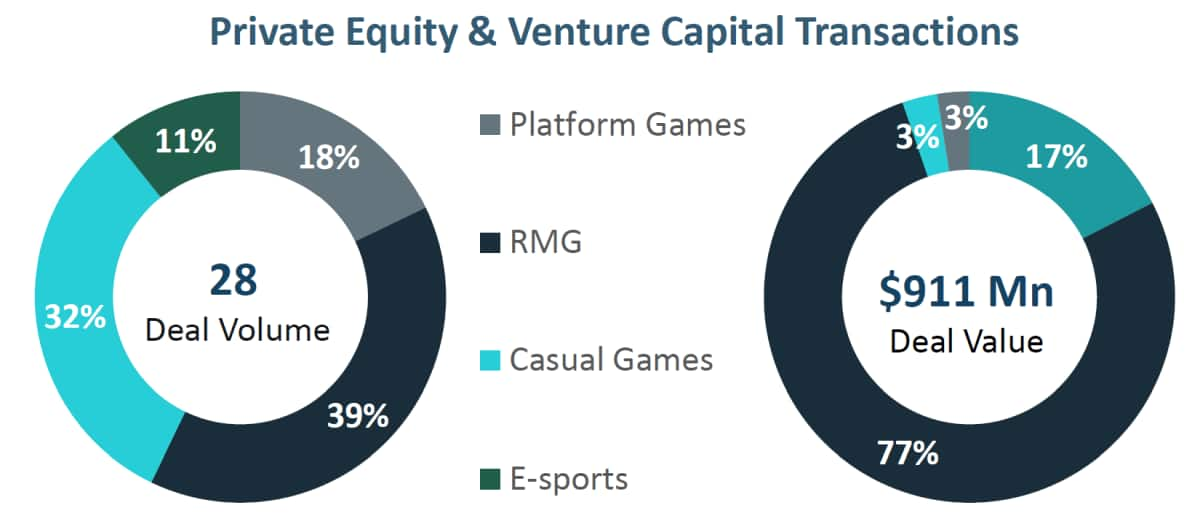

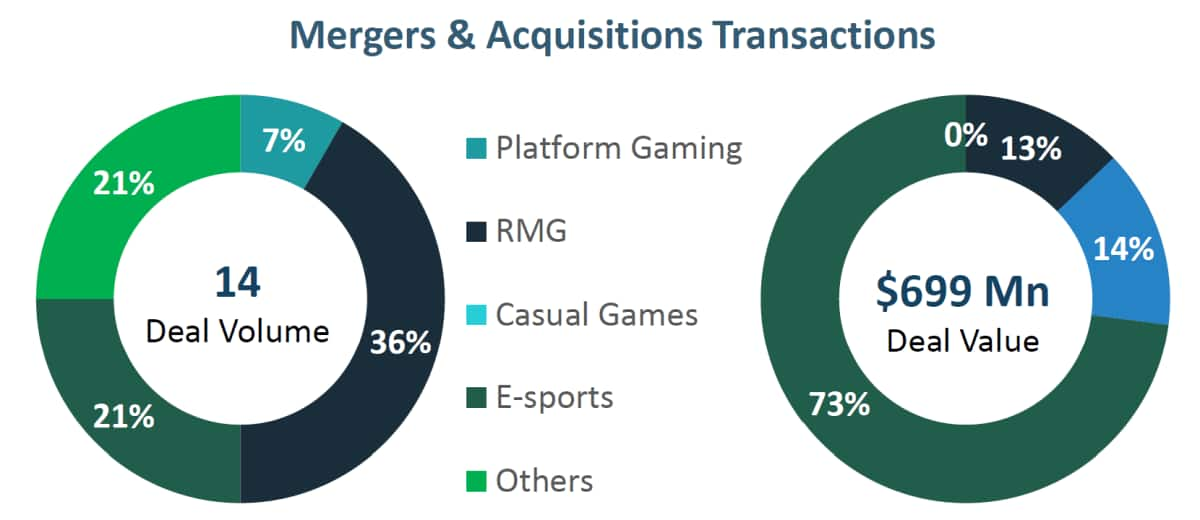

Gaming startups bagged around $911 million from venture capital (VC) firms and private equity (PE) players for the first nine months of the year, while the sector witnessed mergers and acquisition deals worth $699 million, bringing the total investment in the sector to around $1.6 billion for the period, as per a report by Maple Advisors developed in partnership with All India Gaming Federation (AIGF) and Ikigai Law.

To put things to context, the gaming sector in India had attracted $350 million in investments from VC firms between 2014 and first few months of 2020, growing at a compound annual growth rate of 22 percent, according to an August 2020 report by Maple Capital Advisors.

During the August 2020-January 2021 period, the sector had attracted a total $544 million in investments, which include both venture financing and acquisition deals.

“Given the size of India’s population, increasing user traction, and ARPU, global gaming players (strategics) & global private equity funds have already started showing interest in the Indian gaming ecosystem. With the rise of esports and immersive media gaming companies in India, we expect further deepening of the market. Overall, we expect the investments to double in the next 12-18 months” said Pankaj Karna, Founder & MD, Maple Capital Advisors.

Gaming platforms and Fantasy Sports attract majority of investmentsThe sector saw 42 deals during the nine month period, of which 28 were VC and PE transactions and 14 were acquisition deals.

Real money games and fantasy sports attracted the majority of the investments in the sector, bagging around $700 million in the first nine months of 2021. This however does not include the mammoth $840 million funding that Dream Sports announced on November 24.

Real money games accounted for 39% of the VC and PE transactions for the period followed by Casual games (32%), gaming platforms (18%) and E-sports (11%).

In terms of mergers and acquisitions, real money games contributed for 36% of the deal volume for the nine month period, followed by E-Sports (21%), Casual gaming (7%) and others (21%).

In next 12-18 months, gaming platforms and e-sports segment will witness large capital infusion from growth VCs & PEs while many new immersive media gaming companies are likely to attract early stage investors, the report said.

It added that the sector has also started witnessing consolidation, with large companies looking to expand their presence through inorganic growth.

With the rapid growth of the country's gaming market, several global players are also likely to explore the India market through partnering/acquiring domestic companies in the next 12-18 months, the report said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.