Borrowing costs of small and mid-sized non-banking financial companies (NBFCs) have spiked by up to 200 basis points (bps) in the last two months as the Reserve Bank of India (RBI) began its rate hike cycle to combat inflationary pressures. One bps is one hundredth of a percentage point.

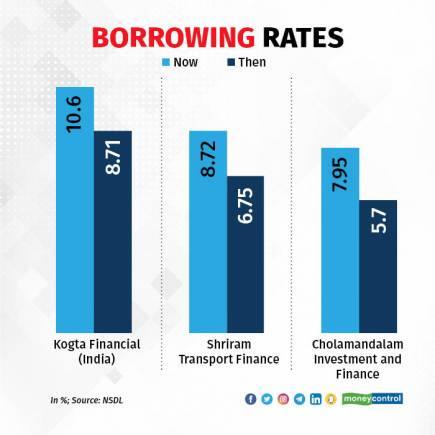

For instance, Kogta Financial (India), rated A- by ICRA, raised funds via three-year bonds in May at 10.60 percent coupon. In March this year, in comparison, it had issued a 30-month bond at 8.71 percent coupon. There are more such examples.

Shriram Transport Finance, which is rated AA+ by India Ratings, issued a near-three-year bond at 8.72 percent in May, against a two-year bond at 6.75 percent coupon in April 2021. Cholamandalam Investment and Finance raised funds via five-year bonds at a 7.95 percent coupon in May, compared with a yield of 5.7 percent for a two-year bond in May last year. Cholamandalam Investment is rated AA+ by ICRA.

“Besides the recent rate hikes of about 90 basis points by the RBI, the credit guarantee schemes announced by the government specifically to provide ample liquidity for NBFCs and microfinance institutions are almost exhausted,” said Venkatakrishnan Srinivasan, founder and managing partner at Rockfort Fincap, a Mumbai-based debt advisory firm.

“The cost of borrowing for most of these institutions has already risen between 200 and 300 bps depending on their credit rating,” he added.

Yield on the 10-year government security has spiked 77 bps so far this fiscal as global and domestic inflationary pressures led central banks across the world to scale back pandemic-era easy money programmes. The 10-year yield rose to a near three-year high of 7.61 percent in intraday trade on Monday. Bond prices and yields move in opposite directions and reflect the outlook of interest rates in an economy.

Corporate bonds are comparatively low-risk investment as they ensure capital protection. However, these bonds are not entirely safe. This is why investors demand a certain premium to invest in these securities over and above the G-sec or government security rate. The difference between the two rates is called the spread. The higher the spread, the riskier is the investment.

The RBI’s Monetary Policy Committee (MPC) increased the repo rate by a total of 90 bps in May and June amid inflationary pressures, leading to a spike in bond yields.

The RBI’s assessment of persistently high inflation is the biggest worry for policymakers at the moment. Inflation, according to the RBI, is expected to stay above the central bank’s upper tolerance level for three quarters of this financial year and average at 6.7 percent for FY23. Market participants expect the MPC to hike rates by another 25 to 40 bps in the August policy.

The RBI is currently looking to withdraw pandemic-era accommodation to keep a lid on soaring price pressures in the economy. It has stopped its own quantitative easing-style Government Securities Acquisition Programme (G-SAP) since October last year and is indulging in reverse repo auctions to suck out excess liquidity from the banking system.

The cash reserve ratio (CRR), or the portion of deposits that banks must hold in liquid cash, was hiked unexpectedly by 50 bps at the MPC’s off-cycle meeting in May with the aim to withdraw Rs 87,000 crore from the banking system.

“During Covid corporate bond spreads had compressed drastically because of ample liquidity and low corporate bond issuance,” said Sanjay Pawar, fund manager (fixed income) at LIC Mutual Fund Asset Management.

“However, now with RBI's continuous liquidity normalisation like introduction of standing deposit facility, CRR hike, variable rate reverse repo has drained system liquidity significantly resulting in widening of corporate bonds spreads,” Pawar added.

Shift to bank loansExperts said that there are limited avenues available to small and mid-sized NBFCs for raising funds and they are generally elbowed out of the market by the better-rated larger corporates while procuring funds. The revival of the investment market is still at a nascent stage and, therefore, smaller players have to borrow at higher costs.

In this financial year so far, top-rated AAA papers like those from SIDBI, EXIM Bank and Bajaj Finance have been able to raise funds at relatively better rates in comparison to lower-rated corporates that have either struggled to or abstained from raising funds from the debt market. This is largely because of their credit rating and borrower profile, said money market dealers.

“Due to the limited availability of funds from the bond market, below AAA-rated corporates have comparatively fewer chances and, therefore, have to rely more on bank loans for their funding requirements,” said Jyoti Prakash Gadia, managing director at Resurgent India, an investment banking firm.

A senior official at an AA-rated NBFC agreed with Gadia’s view.

“Most lower-rated NBFCs had tapped the debt market heavily in the last two years and had raised funds at cheaper rates,” the official said on condition of anonymity. “Now, the G-sec yield has risen at a faster pace compared to bank MCLR (marginal cost of fund-based lending rate). So in such a scenario, a lower-rated NBFC will mostly lean towards bank credit.”

High borrowing costs to persistExperts said that the trend is likely to persist in the corporate bond market and lower-rated NBFCs may see higher borrowing costs continue at least in this financial year. With persistent demand-supply mismatch, prospects of sticky inflation and high crude oil prices, the trend of higher borrowing costs is likely to be faced by mid- and lower-rated NBFCs.

“With the expectation of continuous repo rate hikes, the borrowing cost of these institutions will go up further,” said Rockfort Fincap’s Srinivasan. “The borrowing cost will further fuel up when the RBI drains out liquidity in a calibrated manner.”

AAA-rated corporates will be rushing to tap the market before the rate hikes in August and liquidity draining out, but that may not be the case with lower-rated NBFCs, he added. The borrowing cost will increase in every bond issuances as the main concern is to control inflation.

LIC Mutual Fund’s Pawar said that majority of issuances should come in the second half of this fiscal year when the government's weekly debt supply reduces and corporate demand for funds rises in the festive season.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.