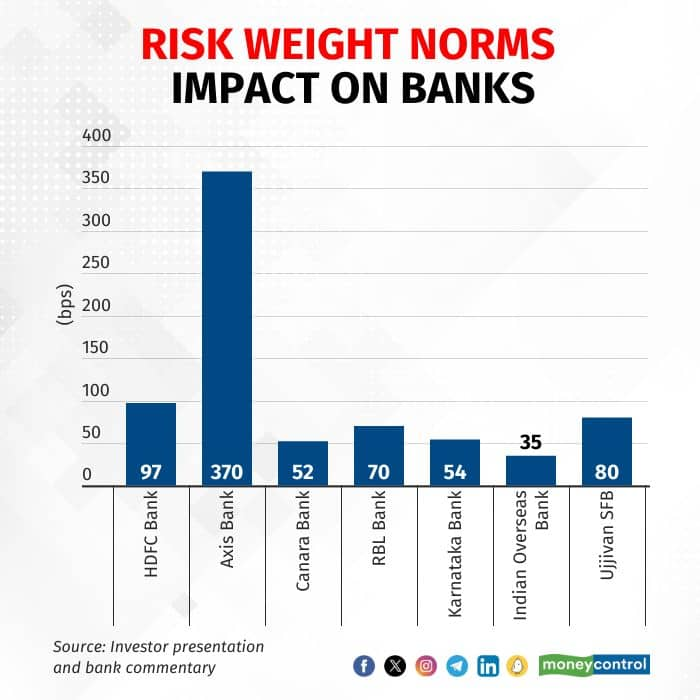

An analysis of seven major banks, which have announced earnings in the third quarter of FY24 shows that the recent increase in the risk-weight norms by the Reserve Bank of India (RBI) on consumer loans has impacted their capital ratios by an average of 51 basis points (bps).

The new norms require banks to set aside a higher amount to cover the potential losses in this category.

On November 16, the RBI increased the risk weight by 25 percent on consumer credit exposure of commercial banks and non-banking finance companies (NBFCs).

Data shows that HDFC Bank saw an impact of 97 bps on its capital-to-risk-weighted asset ratio (CRAR) whereas RBL Bank had an impact of 70 bps.

Karnataka Bank was impacted by 53.9 bps and public sector lenders Canara Bank and Indian Overseas Bank had an impact of 52 bps and 35 bps, respectively. Similarly, Ujjivan Small Finance Bank had an impact of 80 bps on its CRAR. On the other side, Axis Bank, in its investor presentation, said that the bank had an impact of 370 bps.

Also read: Banks may face pressure on interest margins as growth momentum in credit, deposits continues

What are the RBI norms?

According to the new norms, consumer credit of commercial banks and NBFCs will attract a higher risk weight of 125 percent, instead of the earlier 100 percent.

The RBI move followed a warning from RBI Governor Shaktikanta Das in the October monetary policy when he flagged the high growth in certain components of consumer credit. Das further advised banks and NBFCs to strengthen their internal surveillance mechanisms, address the build-up of risks, if any, and institute suitable safeguards, in their interest.

The increase in the risk weights of consumer credit exposure of commercial banks (outstanding as well as new) impacts personal loans but excludes housing loans, education loans, vehicle loans and loans secured by gold and gold jewellery, the RBI circular said.

What do banks say?

Bankers said that they are comfortable with the impact of the norms on their CRAR and some banks have made changes in the chargeable interest rates.

“We do not have any exposure which will be impacted, and all of whatever we had to do on the provincial norms have already been adhered to. So, we are quite comfortable with that,” said Srikrishnan H, MD&CEO, Karnataka Bank.

In an interaction with Moneycontrol on January 23, R Subramaniakumar, Managing Director and Chief Executive Officer (MD and CEO), RBL Bank, said: “The circular from the central bank came in November and the impact was seen in December. We actually increased the risk weight on credit cards by 25 percentage points. We had an impact of 70 bps on our capital ratio, given that we had the ratings done for unrated clients as we have been able to generate some capital efficiency.”

Federal Bank said that it has reviewed its pricing on personal loans after the recent RBI move to increase the risk weight. “We have reviewed our pricing and have announced a few changes to our rates for personal loans and credit cards,” said Shalini Warrier, Executive Director, Federal Bank.

Industry experts say caution warranted

Going ahead, experts said that, from a growth perspective, personal, unsecured and other loans remain attractive for banks but there's a need for caution on banks' asset quality.

“The non-performing assets in certain segments of unsecured loans, like in the small-ticket size segment, could see an increase in the days ahead, given the vulnerabilities of the borrower segment,” said Subha Sri Narayanan, Director, CRISIL Ratings.

“From a growth perspective, this segment does remain attractive for banks. At the same time, we believe they would look to calibrate growth with greater sensitivity for maintaining asset quality in the days ahead,” she said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!