Typically when an equity scheme completes three years, investment advisors and analysts start looking at it seriously. Fund managers of such schemes start engaging with investors and distributors as they have some performance to talk about.

DSP Quant Fund (DSPQ), however, is approaching investors with a proposal to change a few fundamental attributes of the scheme. What’s changing?

Performance attracts investors

DSPQ builds a portfolio of stocks chosen on the basis of growth, quality and value parameters, using a rule-based model. It chooses its stocks from the top 200 largest listed stocks.

As on 31st May 2022, the scheme managed assets worth Rs 1,283 crore, making it the second-largest quant focused mutual fund scheme in India. The scheme has given returns of 12.9 percent for the three years ended June 14, 2022, compared to 10.74 percent returns given by large-cap funds, as per Value Research. The scheme’s benchmark S&P BSE 200 TRI has given a return of 17.82 percent over three years. The portfolio of the scheme is large-cap biased, with nearly 86 percent in large-cap stocks, as on May 31, 2022.

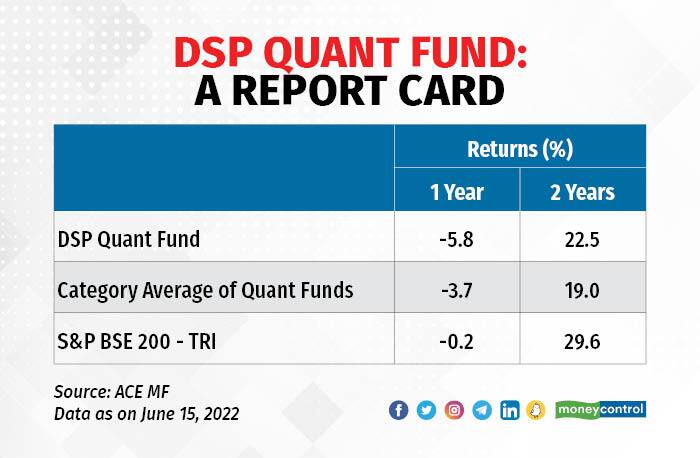

DSPQ has, however, seen some underperformance against its peers in the quant segment as well as the overall large-cap funds category in the recent past. It figured at the bottom in quant funds over the last 6-month period, recording a loss of 16.47 percent compared to a loss of 10.08 percent by large-cap funds.

“Over the last few months, we have seen high-quality and high-growth stocks being offloaded in the stock market. That could have been a reason why this fund has underperformed in the recent past,” says Ravi Kumar TV, Founder of Bengaluru-based Gaining Ground Investment Services.

What is changing?

DSPQ rebalances its portfolio twice a year. Now, it proposes to rebalance the portfolio every quarter. Quarterly rebalancing should help the portfolio factor in drifts in weights due to extreme price moves.

The second important change is the limit on stock allocation. The maximum the scheme can allocate to one stock is capped at 10 percent and this continues to be the outer limit. However, there is one other limit in place: the fund cannot hold a stock in excess of 10 times the stock’s own weight in the S&P BSE 200 index. That limitation is now being lifted.

The fund house says that many stocks in the S&P BSE 200 index have very low weights; in some cases, less than 10 basis points. A hundred basis points is equal to one percentage point. Capping it to 10 times does not help as the allocation remains below 1 percent and the stock does not make it to the portfolio. Going forward, individual stock allocation may go up in some stocks compared to what it would have been in the earlier version of this model.

“By removing the cap of 10 times of the stock weight in the BSE 200 index, we may end up adding a couple of stocks with around 1 percent weight each. The impact may be minimal and we expect the portfolio to continue as a large-cap stocks heavy portfolio, as it is now,” says Aparna Karnik, senior vice president and head of risk and quantitative analysis, DSP Mutual Fund.

So far, stock exclusion and selection has been done using a multi-factor model. Initially the model excludes stocks that do not pass filters such as threshold volatility, forensic accounting and default risk. After excluding such weak stocks, the model screens the remaining stocks based on five metrics capturing quality, growth and value parameters.

Earlier, based on their weight in the BSE 200 index, the stocks would get allocation in the DSPQ portfolio. However, now it is proposed that the model will also consider price-volume data to figure out investor behaviour. This data would include liquidity, price momentum and volatility to optimise the weight of stocks in a rule-based manner for all stocks chosen by screening their fundamentals.

DSPQ also intends to sell call options against the stocks it holds and to pocket the premium. This covered-call strategy can improve the returns of the scheme, especially in a sideways or downward moving market. The fund house has made it clear that the covered call strategy will be used sparingly and won’t be a meaningful part of the investment strategy.

“The proposed changes in the investment process are incremental in nature and in no way changing our core investment process nor our focus on the quality-growth-value trinity while building the stock portfolio. Refinement of the model is a continuous process and will help us to align our portfolio to the impact of frequent sector rotation and shorter-than-expected market cycles,” says Karnik.

What should you do?

Since the changes mentioned above qualify as a change of fundamental attributes, the fund house has sent a notice to all unit holders. Per mutual fund regulations, the fund house has opened an exit window for existing unitholders to switch out of the scheme or seek redemption without paying any exit load, if applicable, within a 30-day exit period. The exit period starts June 16, 2022 and ends July 15, 2022 (both days inclusive). Exit is optional and not mandatory. Investors comfortable with the changes can ignore the notice and continue with their investment plans.

“Investors looking for a high-quality, high-growth stock portfolio designed by a rule-based model for the long term, should consider this fund. The rule-based portfolio eliminates the fund manager risk and should offer healthy risk-adjusted returns,” says Ravi Kumar.

Quant models need to be reviewed regularly and the process needs to be fine-tuned. A volatile phase in the stock market is an opportune time to implement such changes. Given the focus on large-caps and some allocations to large-sized mid-cap stocks, the evolution of the investment process can work in favour of investors.

“DSPQ’s smart beta strategy should offer a bit more in returns than those offered by underlying benchmarks in good times but can contain a downside in bearish phases,” says Rupesh Bhansali, Head, Mutual Funds, GEPL Capital. Over the medium term, this can be an effective portfolio candidate for investors looking for more than market returns but uncomfortable with fund manager risk, he adds.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!