Last Friday, the RBI (Reserve Bank of India) gave banks the option of deferring the dues of credit card users. They now have the option of postponing their upcoming payments until May 31. Several banks have laid out steps for making use of the moratorium. Credit card dues from March 1 to May 31, 2020 will be eligible for the deferment.

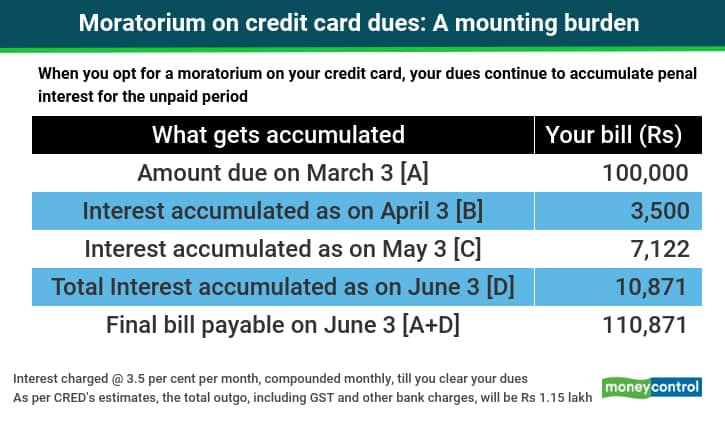

The moratorium is merely a deferment, and not waiver. So, your outstanding dues will continue to accumulate interest during the moratorium or until you clear the bills. In fact, banks themselves have reiterated this aspect in their communication to customers. It could snowball into an unwieldy sum by June, since interest rates on credit card dues are upwards of 40 per cent per annum.

Moreover, if you hold multiple credit cards with the same bank (such as your own plus an add-on card), opting for moratorium on one card’s outstanding could affect all other cards’ dues too, depending on your bank’s policy. “If you opt for moratorium on any one credit card, it will be applicable on all credit cards held by you,” says an ICICI Bank statement issued on April 1. Put together, the interest payable across cards could well be a nightmare to deal with once the moratorium ends, if you are habituated to running huge credit card bills.

With the total credit card outstanding as on February 28, 2020 topping Rs 1.1 trillion, the number of people opting for a moratorium is bound to have a considerable impact on individual finances as well as the banking system over the next two months.

Let’s answer some of your most pressing questions.

Should I specifically request my issuer for the moratorium?The RBI allowed banks to offer moratorium, but has left the implementation to them. So, this is up to the individual banks or card issuers. For example, ICICI Bank and Axis Bank have an ‘opt-in’ facility for credit cards. That is, you have to specifically tell your bank that you wish to opt for the moratorium facility.

HDFC Bank, on the other hand, will treat credit card customers who skip payments for April or May (or have already missed the March dues) as automatically eligible for the moratorium. This option is allowed only if they had been paying their dues regularly until March 1, 2020. “Customers need not call the bank or send any email or SMS confirmations for availing moratorium benefits on credit cards,” HDFC Bank’s FAQ statement said. Some banks are advising their customers to turn-off the ‘auto-debit’ facility – so the credit card due is automatically deducted on the set date. Others have said that the facility will not be triggered in case you have opted for the moratorium.

When will I have to pay up once I take the moratorium?In such cases, you will have to clear the dues as reflected in your June 2020 statement or at least pay the minimum amount due. “The amount mentioned in your June 2020 statement would include all previous outstanding against which payment is not done, principal amount on transactions done during the moratorium period and interest levied,” explains Adhil Shetty, CEO, Bankbazaar.

Yes. And, that is why you need to be careful while opting for the moratorium. Use the flexibility only if you have no funds to pay your dues. Interest will compound during the moratorium period, adding to your burden. “In the case of credit cards, you have always had the option of paying the minimum amount due (5 per cent of the outstanding) in case of a financial crunch. The moratorium does not offer any great additional benefit,” says Pankaj Mathpal, Founder, Optima Money Managers. In case you pay only the minimum amount due, too, you must treat it as an interim measure and strive off to pay off the entire outstanding as soon as possible. It represents a tiny portion of your outstanding amount and the balance will continue to attract exorbitant interest. It’s best to meet the repayment schedule unless you are facing a financial distress.

You can avoid a default and a bad credit score. So, a temporary relief measure is already available for credit card customers. It is not better or worse than the moratorium, given that the interest burden would be exorbitant in both cases.

If I have utilised a part of my balance and decide not to pay my bill on April 1, will I still be able to utilise the remaining portion during April and May?That depends on your bank’s approach. You might still get to use the balance limit.

“Under normal circumstances, the limit gets blocked when a user does not pay the minimum amount due in that payment cycle. However, banks could offer relief to customers under the moratorium,” says Kunal Shah, Founder and CEO of CRED.

Read your bank or card issuer’s FAQ before taking a call – some banks will allow you to continue transacting using your card, some won’t. “If you opt for a moratorium, you will not be allowed to make any fresh purchases. This restriction will be lifted once you pay at least the minimum amount due as indicated in your June’20 statement,” the Axis Bank FAQ statement says.

On the other hand, ICICI Bank will allow you to transact, but could place restrictions. “While you will be able to transact, your transaction privileges may be modified as per the discretion of the bank during the moratorium period,” its statement says.

If my cash crunch eases, can I make some payment towards my card dues during the moratorium?Yes, you can. You will be charged interest only on the outstanding amount.

Will availing the moratorium affect my credit score?No. Skipping payments after availing the facility will not be treated as default and, hence, not be reported to the credit bureaus. Your credit score will remain unaffected during the period of the moratorium. Banks will not levy late payment charges either.

What happens to my reward points?Reward points act as incentives for using credit cards and, over time, you get an opportunity to redeem these points against products and services of your choice. “In case of a default, ordinarily, the reward points accumulated get blocked. Since non-payment during the moratorium period will not be considered as default, your bank could keep accumulating these points on your transactions,” says Sukanya Kumar, CEO, Retaillending.com. ICICI Bank has put out details on reward points. “You will keep on earning reward points on your transactions as per your card’s policy….in moratorium period also,” it says.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.