At a time when most central banks in major economies have raised interest rates, the Reserve Bank of India decided to maintain status quo on key policy rates, paving the way for cheaper interest in home loans to stay for now.

The Monetary Policy Committee (MPC) of the RBI left repo rate - the external benchmark that most banks use for pricing their retail floating-rate loans – unchanged in its monetary policy resolution. For now, banks will not increase interest rates for floating-rate home loans sanctioned after October 1, 2019, when the external benchmarking regime came into force.

The MPC also retained the accommodative stance, though the statement did signal the start of withdrawal of this stance to keep inflation in check.

Also read: Das finally picks inflation over growth, how soon will MPC hike rates?

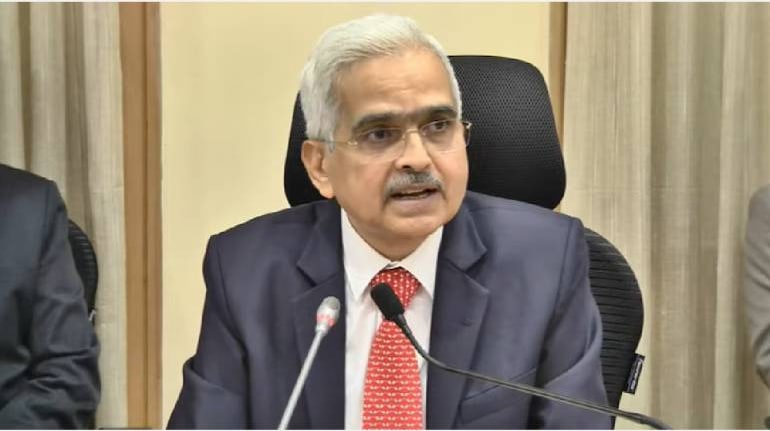

Lower risk-weightage for high LTV loans extended to March 2023The central bank extended the lower risk weightage allowed for individual home loans with high loan-to-value ratio by another year to March 31, 2023. “The risk weights for individual housing loans were rationalised in October 2020 by linking them only with loan-to -value (LTV) ratios for all new housing loans sanctioned up to March 31, 2022," RBI Governor Shaktikanta Das said in his statement.

"Recognising the importance of the housing sector and its multiplier effects, it has been decided to extend the applicability of these guidelines till March 31, 2023. This will facilitate higher credit flow for individual housing loans,” he said.

In its October 2020 monetary policy review, the RBI had stated that such loans would attract a risk-weight of 35 percent in cases where LTV is up to 80 percent, and a risk weight of 50 percent where LTV is between 80 percent and 90 percent. The relaxation will continue for another year.

LTV denotes the quantum of loan that can be sanctioned to a borrower against the property value. For instance, an 80-percent LTV indicates that the borrower can take a loan of up to 80 percent of the property value. So, if the property value is Rs 1 crore, a loan of up to Rs 80 lakh can be taken and the rest has to be funded by home buyers out of their own pockets.

For lending institutions, a low-risk weightage means lower capital provisioning, which will eventually reduce their cost of funds and, as a result, will lead to lower lending rates for borrowers with high LTV loans.

“As far as the loan sector is concerned, with no change in the repo rate, the loans are not getting any costlier for now. Also, the rationalisation of risk for individual home loans has been extended till March 31, 2023, which will boost participation in this sector,” said V Swaminathan, CEO, Andromeda and Apnapaisa.

Dhruv Agarwala, Group CEO, Housing.com, Makaan.com and PropTiger.com, echoed the thought. “Extending the applicability of LTV ratio till March 31, 2023 will facilitate higher credit flow for individual housing loans. The RBI has recognised the importance of the housing sector and its multiplier effects on the economy," he said.

Sales numbers indicate that India’s real estate sector is marching steadily towards a more sustained recovery and support policies like these will help it further, feels Agarwala.

Benign home loan rates and friendlier terms and conditions will continue to boost demand, which is on an upswing since last year. “Banks will be able to lend more, resulting in increased supply, and hence tougher competition among lenders. An increase in demand of home loans is already there since last year. Reduced home loan rates will continue to push up demand, especially in the affordable housing space,” said Aarti Khanna, Founder and CEO, Askcred.com.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.