Power Finance Corporation (PFC) is raising Rs 5,000 crore by issuing non-convertible debentures (NCDs). Coming from a public sector enterprise, it is being seen as an opportunity by many fixed income investors for investing, especially given the current low-yield environment. But is it really worth invest in the issue?

What’s on offer

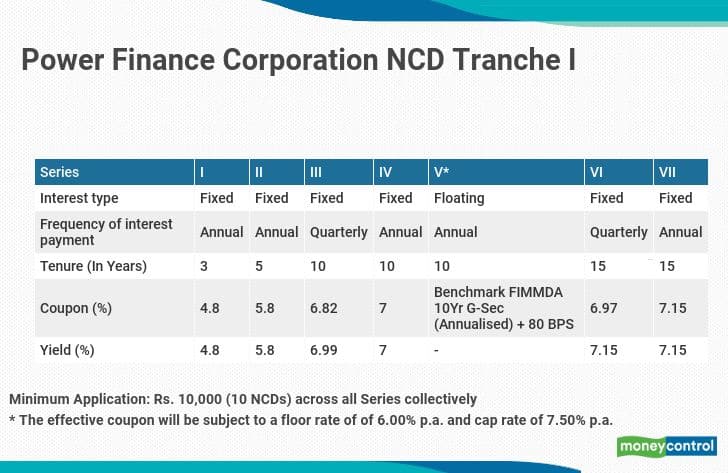

PFC plans to issue secured, redeemable NCDs in dematerialized form on a first-come first-serve basis. The issue opens on January 15, 2020. Three credit rating agencies – CRISIL, ICRA and CARE – have given AAA rating to this issue. The minimum application size is 10 NCDs, aggregating to Rs 10,000 collectively across all series of NCDs and in multiples of One NCD of face value of Rs 1000 each thereafter.

PFC is a non-banking financial institution engaged in the business of extending loans to the power sector.

There are seven different options that PFC offers in the proposed NCD issue. Three and five-year bonds offer annual payouts of interest at the rate of 4.8 percent and 5.8 percent, respectively. On 10-year bonds, you have the option of choosing quarterly or yearly payout with coupons of 6.82 and 7 percent, respectively. You also have the option of floating-rate 10-year bonds that pay 80 basis points more than the Benchmark FIMMDA 10-Year G-Sec (annualized) – subject to a minimum of 6 percent and a maximum of 7.5 percent. In the 15-year tenure, you have two options to receive coupons at the rate of 6.97 and 7.15 percent for quarterly and yearly periods, respectively.

The NCD will be listed on the BSE. There is no put or call option attached to these NCD. The issue closes on January 29, 2021.

What works

The issuer is a central public sector enterprise and has the highest credit rating from three agencies. This indicates least credit risk. The listing on the stock exchange would allow investors to exit before maturity if they need to. Vikram Dalal, Founder & Managing Director of Mumbai based Synergee Capital Services says, “Since this is a large issue of Rs 5000 crore, the bonds are more likely to see good liquidity on the stock exchanges.”

Tax will not be deducted at source on interest paid.

“Comparable 10-year AAA-rated PSU bonds are quoting in the range of 6.5 to 6.6 percent. As this bond offers 7 percent, there is a potential for listing gains,” says Deepak Panjwani, Head-Debt Markets, GEPL Capital.

What doesn’t

The interest paid on these bonds are taxable in the hands of investors. Hence, individual investors in the higher tax slabs may not find it attractive.

The rates offered are low. For example, the three-year NCD offers 4.8 percent. This is way below the 5.3 percent rate of interest offered by SBI on its three-year fixed deposits. Same is the case with the five-year NCD variant that offers 5.8 percent. The five-year National Saving Certificate pays interest at the rate of 6.8 percent compounded annually at the time of maturity.

That leaves you with long term choices maturing in 10 and 15 years, which may not be suitable for many investors given their liquidity needs.

Should you invest?

Joydeep Sen, Author and Corporate Trainer (Debt Market) finds returns on the 10-year and longer maturity NCDs attractive. “It is difficult to predict where interest rates will move over next 10 years. It is better to stay with the fixed interest option as you get an opportunity to lock into the rates and protect yourself against the possibility of interest rates coming down,” he says.

NCDs maturing in 10 years offer 7 percent rate of interest, which looks fairly attractive compared to other options. Dalal points out, “It is tad above 6.6 percent yield at which other bonds issued by similar AAA rated PSU entities quote. It is also slightly better than the 4.4-4.45 percent yield given by tax free bonds.”

Senior citizens should ideally first exhaust their limits under the senior citizen saving scheme and Pradhan Mantri Vay Vandana Yojana. Even if you are keen to apply for the 10-year or 15-year options, then do so only if you are willing to stay invested till maturity. From a credit risk perspective, that’s a long tenure to hold on to NCDs, even if they are highly-rated ones. Besides, there is no assurance that the bonds would trade near fair value.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!