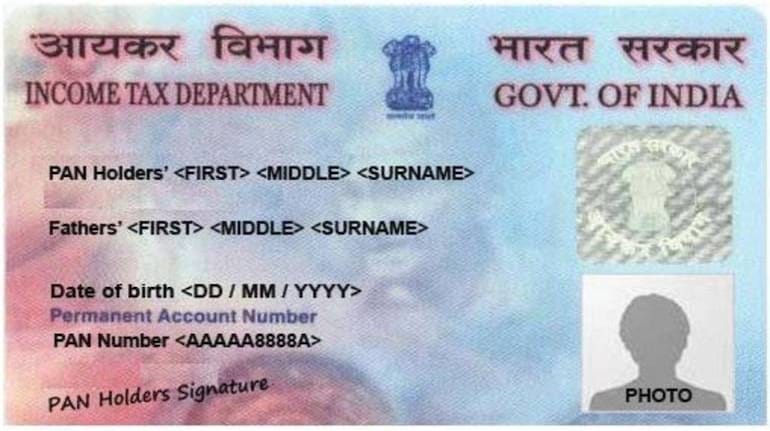

The government's IT department has launched an online new facility that allows an Aadhaar card-holder to get a Permanent Account Number (PAN) within minutes.

A PAN is generated in just 10 minutes in a PDF format and the e-PAN is as good as a physical copy.

To do get a PAN card, go to the e-filing portal and click on the ‘Ínstant PAN through Aadhaar’, then select ‘Get New PAN’. You will be asked the Aadhaar number and an OTP will be sent to the registered mobile number. After the validation of OTP, an e-PAN will be generated.

A PAN card is an essential document required for at least five of these tasks:

Real Estate purchase: If you are planning to buy a property valued at Rs 5 lakh or above, it will be mandatory for you to provide PAN .

Credit Card: A PAN card is mandatory for issuing credit and debit cards. It is also needed for post office savings account.

Insurance Premium: PAN card is required for a life insurance premium of more than Rs 50,000.

Transactions above Rs 50,000: If you are filing an income tax return, then it is important that you link PAN and Aadhaar number. A PAN card is also needed for a cash purchase of bank draft, pay orders or bankers cheque of Rs 50,000 or above in a day.

For TD or FD: If you buy securities or mutual fund units worth more than Rs 1 lakh, then PAN is a must.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!