The year 2022 saw many upheavals and downsides in the investing world. While benchmark indices Sensex and Nifty touched lifetime highs of 63,583.07 and 18,887.60, respectively, the debt market saw interest rates rising continuously over the last year.

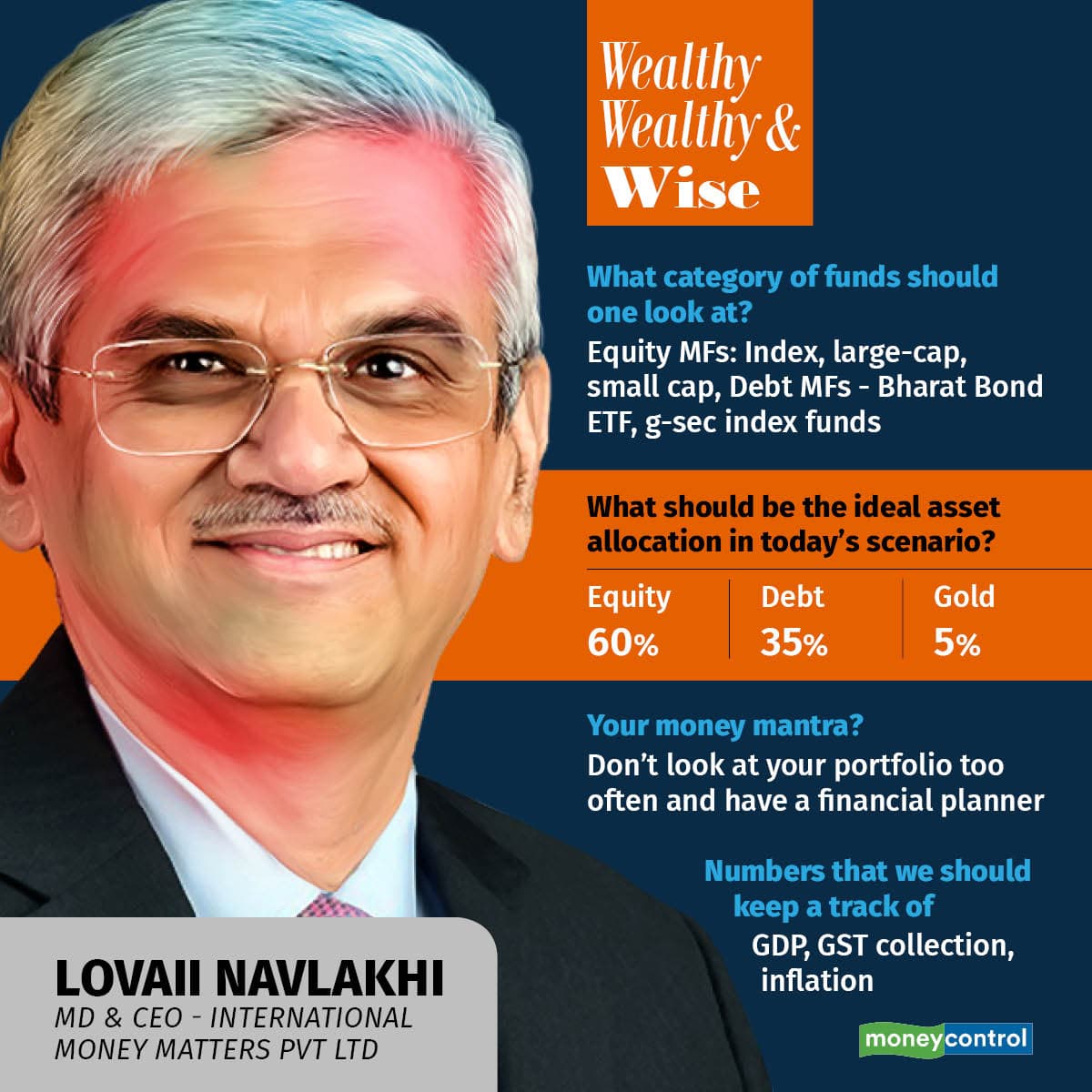

Lovaii Navlakhi, managing director and chief executive officer of International Money Matters Pvt. Ltd., believes the debt market is going to yield better results in 2023, while equity is seen remaining fairly volatile.

A financial advisor with over two decades’ experience, Bengaluru-based Navlakhi, has seen many market upturns and downturns. Today, Navlakhi has assets under advice to the tune of Rs 1,800 crore.

In a conversation with Moneycontrol, he talked about where an investor can put Rs 10 lakh today.

Edited excerpts:

If someone has never invested in equity markets, is now a good time to start?

This question has been asked multiple times over many years. The truth is, any time is a good time to enter the equity market. It is just about matching your individual goals, risk profile and the quantum of money you want to invest.

So, assuming I have Rs 10 lakh, where should I invest it?

Any amount of money that one thinks will be needed in the next 12-18 months should be kept aside, very safe, in a liquid fund, arbitrage fund or a short-term fund. If you don’t have any short-term needs, I suggest you put 60 percent in equities. In present times, equity valuations are neither very cheap nor overly expensive. Put 10-15 percent in international funds. This investment should be staggered over a period of 6-12 months.

Five percent can be allocated to gold and the remaining 35 percent can go into fixed income or debt securities.

As we enter 2023, what are the most important indicators that investors should watch for to get a sense of the direction in which the Indian economy is headed?

I think the simplest thing to keep an eye on is GDP (gross domestic product) growth. The direction in which we are growing in, in terms of value of goods and services, might give an indication of what type of returns you should expect from equity.

Another number that can be looked at is the GST (goods and services tax) collection, as it gives a barometer of what people have actually invoiced. These are both growth indicators that can be considered while investing.

Apart from this, inflation numbers can tell you a lot about the economy, but that would impact every individual investor differently. Because if I, for example, spend 50% of my money on food, and you spend 10%, inflation for me might be higher than what it will be for you.

Should we rebalance our portfolios whenever the market hits new highs and lows?

One should build their equity portfolio with a minimum outlook of five years. So, if I am looking at a long-term time horizon, then market highs and lows should not impact my asset allocation.

Your portfolio’s return might change from 9.6 percent to 9.3 percent without rebalancing, but it’s okay as no one is an astrologer and no one can be perfect about market timing. There should not be too much action.

I feel a review once in 12-18 months is good enough. You should rebalance your portfolio if a major event happens in the market or in your personal life.

As a tactical bet (ignoring asset allocation principles and keeping personal circumstances aside), would you recommend debt or equity for the coming year?

Overall, at this point, debt feels like a safer investment. Because we have reached the top of the interest rate cycle, and thus the chances of making good money on debt are higher. There are many low-cost debt funds like (Edelweiss) Bharat Bond Exchange-Traded Fund series or government securities funds index funds to enter into the debt market and make money when interest rates are relatively low.

Equity, in my opinion, will be volatile, but is also likely to give better returns than debt, by the end of the year.

But if you are entering the market for the first time, you can opt for hybrid funds and enjoy the benefits of both debt and equity, without having the fear of losing the principal.

What category of funds should one be looking at while investing in equity as well as debt?

Look at index funds to start with. Large-cap funds are good for a time horizon of 5-7 years. Small-cap funds can be looked at for super-long-term financial goals — ones that are 10-12 years away.

If someone is looking at a time horizon of three years and more, then, as I said, one should put large chunks of their money in categories such as Bharat bond ETF and gilt index funds.

Apart from debt and equity, would you recommend investing in commodities as an asset class? If yes, which are the commodities one should be looking at?

One can look at allocating some amounts to gold and silver ETFs, apart from debt and equity. It doesn’t matter if you put 50-50 or 70-30 in them; in the end a small quantum of money is going towards commodities to build blocks of wealth creation.

When you talk about international investing, what do you recommend — investing in direct stocks in the US or going through the mutual fund route?

It is not suggested to invest into direct stocks overseas, if it is with small amounts of money. It is too complicated a process for a tiny investment. One should go with the funds route. In doing so, logically, some money will go to the US because it is the largest economy. Though the NASDAQ was the favourite exchange till a year ago, I think the S&P 500, which also has a large tech weightage, might be a safer bet, going forward.

One can also invest through funds of funds, which actually let the investor choose the geography of their investment while investing abroad.

Last year was the worst ever for the crypto market. But many investors are still fascinated by it. Some advisors say it’s okay to put 5 percent of your corpus in cryptocurrencies. Would you agree?

Even 5 percent seems too high to me. If someone is okay with losing this money, then it should not even be counted as part of the portfolio. The cryptocurrency market is a highly unregulated market. I would not recommend it.

How many mutual funds should an investor have in their portfolio to avoid any overlapping of stocks?

A maximum of seven to 10 schemes are enough to build a portfolio. It might go up to 12, if someone has some specific goals in mind for which they want to diversify and invest in new schemes. But anything more is over-diversification, because the underlying stocks might be the same as you increase the number of schemes you hold.

What does your own asset allocation look like?

I take my asset allocation decisions after running my risk profile through the financial advisor in my team, who acts like my financial planner.

So, at this point, I have around 55 percent in equity and 45 percent in fixed-income investments. Of the 55 percent equity allocation, 7 percent is in international funds. Around 5 percent lies in gold.

What are your investment mantras?

• Don’t look at your portfolio too often.

• Get a financial planner to handle your finances. Just as everyone needs a doctor and a therapist, everyone needs a financial advisor, too.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!