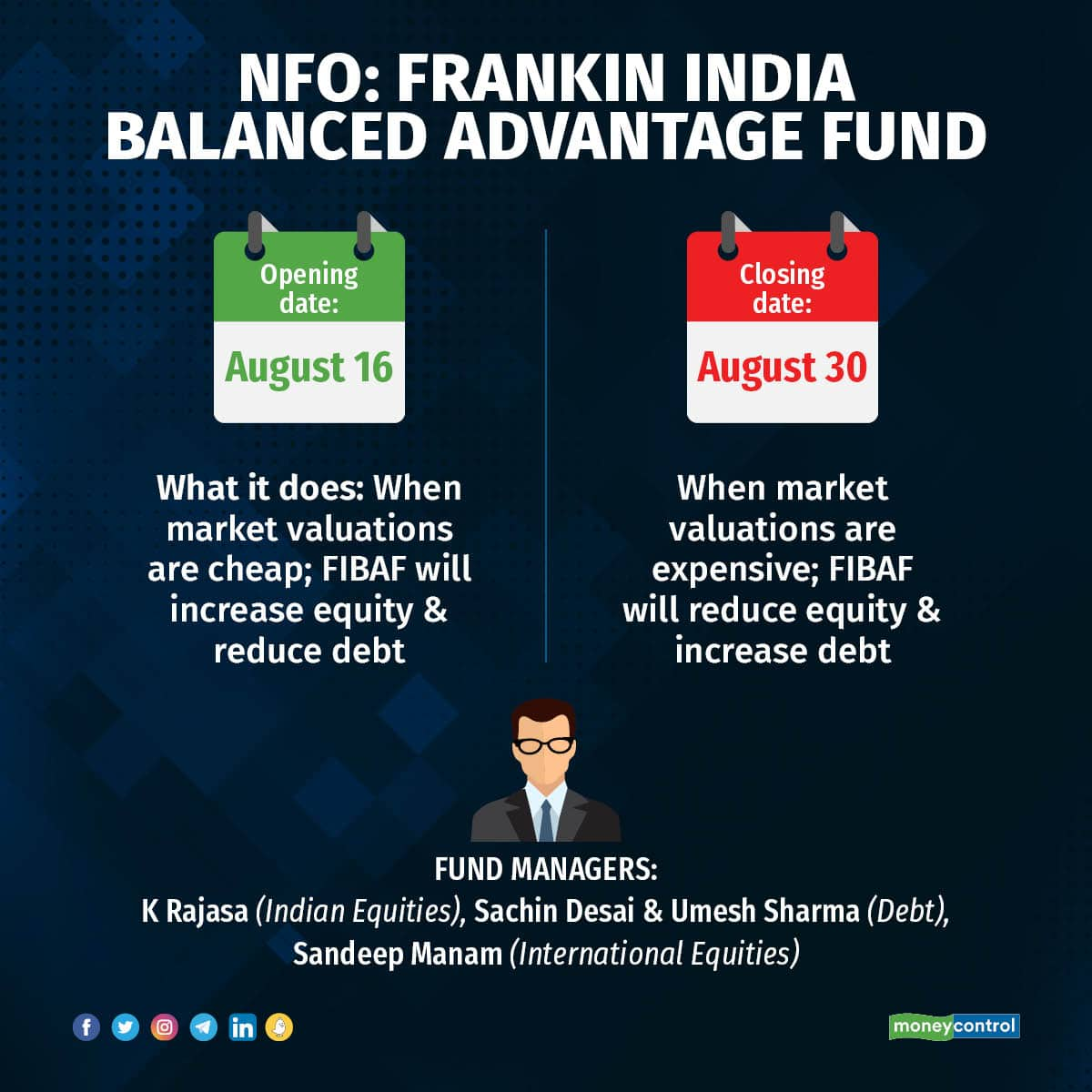

Franklin Templeton Mutual Fund (FT MF) has launched its first new mutual fund scheme since it decided to wind-up six of its debt schemes in April 2020. The new fund offer (NFO) opened on August 16. Moneycontrol was first to report that FT MF's first fund launch since the debt funds crisis will be on August 16.

The fund house has launched a balanced advantage fund (BAF), which is the largest hybrid category (AUM of Rs 1.7 trillion) in the MF industry. Hybrid funds invest in both equity and debt, but BAF also shifts equity-debt exposure dynamically, depending upon how cheap or expensive are market valuations.

The scheme

Franklin India Balanced Advantage Fund (FIBAF) will follow an investment model that uses price-to-earnings and price-to-book multiples to determine how high or low market valuations are, and accordingly increase or reduce equity exposure.

The investment model will give equal weightage to (50:50) to price-to-earnings and price-to-book valuations.

The fund's equity exposure is likely to be in the range of 80-85 percent on the higher side, and 15 percent on the lower side.

If the net equity allocation falls below 65 percent (the minimum requirement for a fund to get preferential equity taxation), the difference will be met by arbitrage allocation.

The scheme will be managed by multiple fund managers. K Rajasa will manage the equity part of the portfolio. Umesh Sharma and Sachin Desai will manage the debt component, and Sandeep Manam will manage any international equity exposure that the fund might take. Anand Radhakrishnan, chief investment officer, FT MF, will be closely overseeing how the fund is being run.

What works?

Franklin India Balanced Advantage Fund (FIBAF) will keep majority of its equity allocation in large caps.

The exposure to large caps will range between 60-85 percent of the equity corpus, while exposure to mid- and small-caps would be in the range of 15-40 percent.

Ravi Kumar TV, founder of Gaining Ground Investment Services, says as investors come to BAFs for lower volatility, a large cap-heavy portfolio works well. It helps curb equity-linked volatility.

On the debt side, FIBAF will invest in higher-rated debt securities on the credit risk curve, but within that the fund will take interest rate views.

"For example, the portfolio duration of the fixed income portfolio of our equity hybrid fund has moved from 2.5 years to 5.5-6 years, which shows that the fund manager has taken the view that interest rates are peaking, and now maybe is a good time to increase the duration of the fixed income portfolio, without going down the credit risk curve," points out Radhakrishnan.

Instead of using valuations of CNX NSE Nifty 50 Index or S&P BSE Sensex 30 for assessing market valuations, FIBAF will factor in valuations of CNX NSE Nifty 500, which is a broader market index.

What doesn’t

FT BAF enters a crowded category where there are already 25 schemes. Five new BAFs were launched in 2021. Earlier this year, Mirae Asset Balanced Advantage Fund was launched in July.

Secondly, choosing one BAF over another can be tricky. All BAFs do not follow the same approach. As per a recent Moneycontrol analysis, there are broadly four different types of BAFs, depending largely on their equity allocation.

Thirdly, different BAFs interpret equity valuations differently. One fund can have high equity exposure, while other BAF may have interpreted the market as expensive and reduced equity exposure.

Some BAFs may also have higher exposure to mid- and small-cap stocks, which might lead to their outperformance when broader markets rally.

On the other hand, low mid- and small-cap exposure, can lead to FIBAF underperforming during such rallies.

A lot will depend upon how efficiently Franklin Templeton India ‘s model signals whether equity valuations are cheap or expensive. This will allow FIBAF to re-balance equity-debt exposure in time to take advantage of any change in market trends.

However, if there is a lag, the fund could underperform.

Moneycontrol’s take

This is not FT MF’s first tryst with a dynamic fund that moves exposure between equity and debt. In fact, the fund house was the first one to launch such a fund in India. The Franklin India Dynamic PE Ratio Fund of Fund (name changed to Franklin India Dynamic Asset Allocation Fund of Funds) was launched in 2003.

It was only later that the MF industry started to launch similar funds in the BAF category.

While the wind-up episode is still fresh in investors’ minds, FT MF has now largely paid back the dues to unitholders. MF distributors say this episode will still impact the flows the fund gets through the NFO. The outcome of FT MF’s appeal at the Securities Appellate Tribunal (SAT) against market regulator Securities and Exchange Board of India order will also have a bearing on how FT MF’s brand is perceived.

Irrespective of SAT’s decision in the debt fund winding up case, Franklin Templeton is here to stay. Its president, Avinash Satwalekar said in the press conference – while announcing the launch of FIBAF recently —that it intends to launch other funds too.

For now, investors can wait till Franklin Templeton India builds a credible track-record in FIBAF over time. The NFO closes on August 30.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!