Growing investor interest in mutual funds has led to an addition of over 1.11 crore new folios in the financial year 2018-19, taking the total to an all-time high of 8.24 crore at the end of March 2019.

Although the additions were lower than the 1.6 crore investor accounts in FY18 fiscal, it was higher than 67 lakh folios added in FY17 and 59 lakh in FY16.

Over the last few years, investor accounts have increased following robust contribution from retail investors, especially from smaller towns and huge inflows in equity schemes.

Fund managers attributed the addition in equity fund folios to the matured behaviour of retail investors who were seeing the market fall as an opportunity to invest their surplus money.

Investors are investing despite the equity market grappling with volatility in the last fiscal.

Folios are numbers designated for individual investor accounts, though one investor can have multiple accounts.

Foreign institutional investor outflows, high crude oil prices and the depreciation of the rupee against the dollar kept Indian equity markets volatile. Amid intermittent volatility, Sensex gained 18.77 percent in FY19.

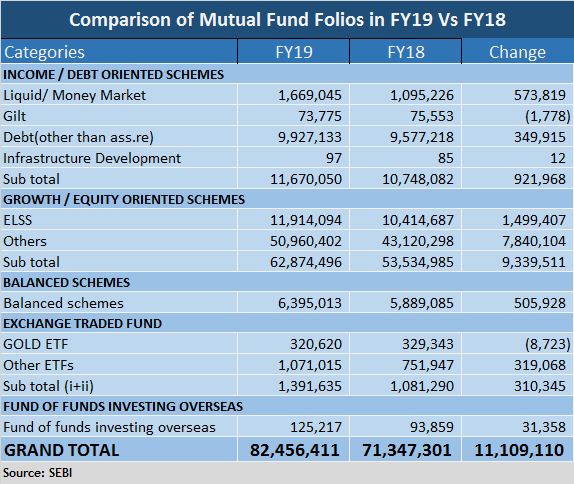

Equity and equity-linked saving schemes (ELSS) added 9.33 lakh investor accounts taking the total folios to 6.28 crore folio during the review period.

Interestingly, liquid funds that were beaten down the most in terms of outflows and fall in the AUM during the last six months of FY19 saw an addition in of 573,819 accounts, while debt funds folios added 3.39 lakh folios during the review period.

Liquid funds ended the year with net inflows of Rs 76,000 crore. Liquid fund assets went up by 32 percent from Rs 4.60 lakh crore to Rs 6.07 lakh crore during the review period.

In September last year, IL&FS had defaulted on repayments. Presence of IL&FS and its subsidiaries in the portfolios of liquid funds had led to a sharp fall in their net asset values, prompting investors to pull out their investments from these funds.

Barring gilt funds and gold exchange-traded funds (ETFs), all categories registered addition in investor accounts.

Folios of investor accounts fell by 1,778 as expectations of tight monetary policy and QE tightening by developed economies led to a lower interest in the gilt category.

However, AMFI CEO NS Venkatesh believes with the monetary policy being dovish, gilt funds will offer investors a good opportunity to earn capital gains.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!