Moneycontrol Research

Highlights:

Boris Johnson elected as the leader of the ruling party in the UK

His stance opens the possibility of 'no-deal' Brexit

Local currency in a weak spot due to Brexit uncertainty

GBP/INR levels remain unfavourable for Indian exporters

Given expectations of higher currency volatility, hedges should be maintained

Boris Johnson’s election as the leader of Conservative party and the PM-designate brings the focus of UK politics back to Brexit. While Boris Johnson won the party leadership position convincingly – 66 percent of votes – his real test would be in Parliament when the debate starts for his Brexit proposal.

The ruling Conservative party enjoys a wafer-thin majority in the House of Commons. Already, Theresa May-led earlier regime had failed several times during the current year in getting the Brexit proposal through the British Parliament.

What it means for Brexit

Twice extended Brexit deadline (October 31) given by European Union (EU) is about three months away. The EU, while acknowledging Boris Johnson’s rise, has hardened its stance on Brexit. Brussels has rejected the incoming British prime minister’s Brexit demands. Newly-appointed European Commission President Ursula Von Der Leyen, who will replace Jean-Claude Juncker on November 1, cautioned that his elevation means “challenging times ahead”.

Johnson’s demand includes complete renegotiation of the Brexit deal with the EU and an alternative proposal for Irish backstop (provision intended to avoid hard border with Ireland). Furthermore, Boris doesn’t back the settlement amount of USD 48 billion with the EU if his demands are not met.

No-deal Brexit possibility

Johnson has clearly spelt out that the Brexit deadline of October 31 would be respected whether or not Brexit deal is agreed on. This opens the possibility of “no-deal” Brexit due to which the local currency has recently depreciated.

If the political logjam persists – both intra UK and between the UK and the EU, no-deal Brexit can be a reality. And if it happens, it means a disorderly exit.

The UK and the EU would not have a stipulated transition period to iron out mutual trade deals. Instead, the UK would have to negotiate with the EU under the aegis of WTO, as it would anyway do it with other countries. In a short term, this means a high disruption to business transaction across the border and lengthy Customs checks, post the deadline. And this can possibly take a toll on economic growth in the near term.

Votaries of no-deal Brexit pitch that a clean break from the EU would help in working out a more rational deal with the bloc later on. However, this scenario doesn’t calm any concern on how the border between Northern Ireland and Ireland would be managed.

USD-GBP in a weak spot

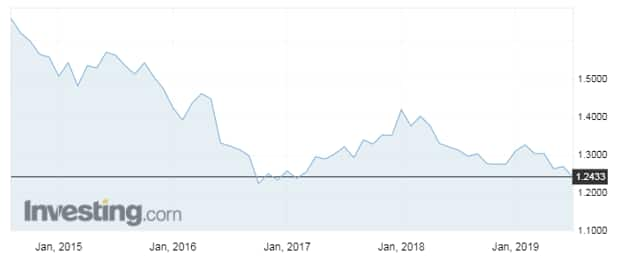

GBP/USD is near a 34-year low and in 2019, it has skidded from the levels of 1.32 to 1.24, given growth uncertainty. Currency volatility, which eased significantly post extension given in March, has recently seen an uptick. In coming days, currency volatility is likely to increase, which makes it prudent to keep hedges intact.

Chart: GBP/USD trajectory

Source: Investing.com

Chart: CBOE/CME FX British Pound Volatility

Source: Investing.com

Coming to Indian investors and businesses having exposure to UK assets, pound depreciation over the period in rupee terms has brought its own share of currency headwinds. GBP/INR has depreciated by ~13 percent from its one-year high reducing competitiveness of Indian exports. This is in addition to concerns due to weak consumer sentiment and business confidence.

Chart: GBP/INR vs. USD/INR (Indexed)

Source: Investing.com

Near-term risk events

So, the Conservative party’s new leadership and Brexit deliberation add to risk events which investors need to keep an eye on. Other being, US-Iran political tensions, US-China trade talks (next round scheduled next week) and global central banks’ policy meets. Of this, ECB meet on July 25, RBA meeting on August 6 and Fed’s policy review on July 30-31 assume importance. All the mentioned central banks are expected to tweak policy rates on the downside.

As per indications from Fed futures, there is 80 percent probability for a 25 bps rate cut by the Federal Reserve in the upcoming policy meet. In fact, there is a rising clamour for a bigger rate cut (50 bps) as recently cited by Judy Shelton, who is President Donald Trump’s likely nominee for the Fed's Board of Governors.

For more research articles, visit our Moneycontrol Research page

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.