Moneycontrol Research

Highlights:

- Disappointing set of numbers by auto majors in all segments

- New axle load norms, tight liquidity and non-availability of finance weigh on CVs

- Delayed monsoon dampened tractors sales

- Two-wheeler and passenger vehicle segments continue to disappoint

--------------------------------------------------

Severe woes continue for Indian automobile sector as most of the companies performed badly, as is evident from their June volume numbers. The muted sentiment is on the back of myriad challenges, led by increase in the total cost of ownership due to mandatory long-term insurance and implementation of safety regulations, higher cost of retail finance and slowdown in economic activities.

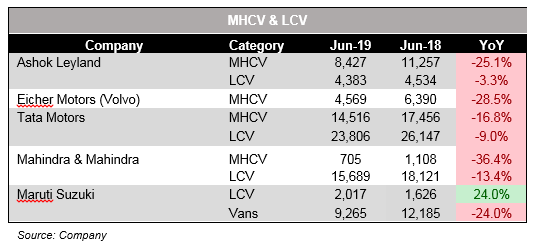

Commercial vehicle (CV) segment numbers witnessed significant decline in the month. Demand scenario continues to be lacklustre for the companies in the segment. Factors such as non-availability of retail finance, lagged impact of new axle load norms and slowdown in economic activities have impacted demand. Tractor segment too continued to remain weak on the back of higher base of last year, delayed rainfall and subdued farm sentiment.

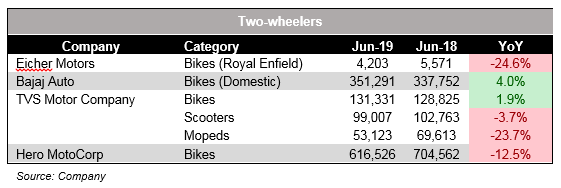

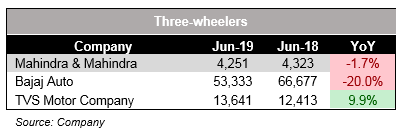

Three-wheeler (3W) sales were mixed on the back of very high base of the past year. Two-wheeler volumes continue to be weak due to higher cost of ownership, high base of the previous year and adverse macro factors.

Commercial Vehicle – Under severe pressure

The demand for M&HCV cargo vehicles continues to be low, with the excess carrying capacity created with the higher axle load regulation last year. Operators are facing viability challenges because of low freight availability and falling freight rates. Furthermore, the liquidity problem, financing issues and slowdown in economic activities have dampened demand.

Company-wise, Tata Motors registered a 12 percent year-on-year (YoY) decline in CV volume, hurt by 16.8 percent decline in M&HCV and 9 percent in LCV segments. Eicher Volvo also witnessed a decline of 28.5 percent. M&M and Ashok Leyland too saw a decline of 15 percent and 19 percent, respectively. The weakness is now extending to the LCV segment as well, which was not the trend earlier.

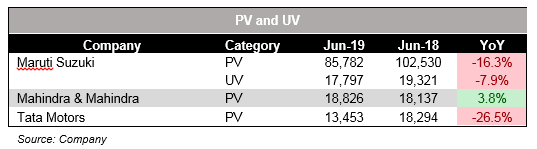

Cars segment – No signs of recovery

Car segment continues to be under huge stress. Muted sentiment in the space is owing to increase in total cost ownership led by mandatory long-term insurance. Additionally, implementation of safety norms has led to increase in prices and impacted sales amid weak consumer sentiment. Hence, companies in the space have registered a decline in PV volume for June.

The leader, Maruti, logged a decline of 15 percent in its volume for the month. The management expects demand to be muted in H1 FY20, which would recover in H2 FY20 to witness 4-5 percent growth in FY20. Tata Motors’ passenger car segment witnessed a decline of 26 percent (YoY).

Two-wheeler (2W) segment: Decline continues

Hero, the leader in the space, took a significant decline of 12.5 percent, Eicher, the leader in premium bike segment, also witnessed a big drop of 24.6 percent in its monthly sales numbers. Bajaj Auto, on the other hand, posted 4 percent growth in its volume on the back of aggressive pricing actions on its entry level segment, which helped it capture Hero’s market share. TVS also suffered a decline of 6 percent in the month.

Three-wheeler (3W): A mixed show

The overall 3W market posted mixed numbers in June. TVS’ grew 9.9 percent while M&M saw a flat growth. Bajaj Auto, the leader in the space, reported a significant decline of 20 percent, primarily due to high base of the past year.

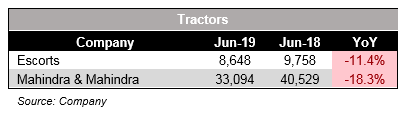

Tractors: Muted farm sentiment impacts demand

Tractor segment has also come under pressure due to lower Rabi sowing than expected and subdued farm sentiment. Escorts sales fell 11.4 percent whereas M&M’s came down 18.3 percent. The M&M management expects that the onset of monsoon and the upcoming Union Budget’s allocations to rural and agri sectors will drive positive sentiment in coming months.

Exports: Mixed sentiment

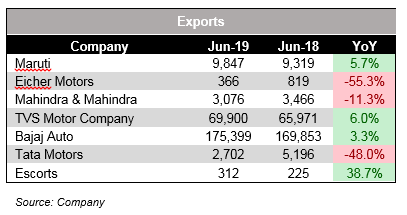

Export markets also showed signs of weakness, as is evident from June numbers. Maruti, TVS, Bajaj Auto and Escorts all posted growth in their export volumes whereas others were hit by a steep decline in volumes. Tata Motors’ management indicated that the decline is due to drop in retail in Bangladesh, Nepal & Middle East markets.

Follow @NitinAgrawal65

For more research articles, visit our Moneycontrol Research page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!