Media reports suggest that one of Mindtree’s large non-promoter shareholders -- VG Siddhartha, who along with his group companies owns about 21 percent in the company, is looking to sell his stake in the company. The list of suitors include rival IT firms such as L&T Infotech and Tech Mahindra as well as private equity investors such as KKR and Fairfax, owned by legendary investor Prem Watsa.

Mindtree’s founders Krishnakumar Natarajan, NS Parthasarathy, Rostow Ravanan and Subroto Bagchi hold 3.72 percent, 1.43 percent, 0.71 percent and 3.1 percent, respectively, in the company and do not want to cede control. They are reportedly working to get a friendly ‘white knight’ to counter the efforts by rivals to gain control over the company.

How will all this affect minority shareholders? The takeover battle clearly reflects that Mindtree is a highly sought after company. It has carved out a niche for itself in new areas, with its early adoption of digital technology, which is beginning to yield rich dividends now. The world has been closely following its success story and many, including its rivals, want to be a part of this journey.

Is there a downside? Shareholders ought to be mindful that should management attention get diverted, amid the ownership tussle, performance might suffer in the highly competitive environment.

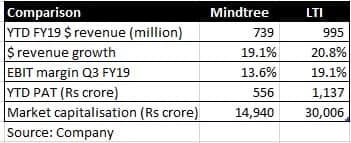

What’s in it for L&T Infotech? Mindtree has created an envious business. L&T Infotech’s (LTI) has undergone a transformation, with digital technology at its core under the new leadership. LTI's earnings speak for itself, with an industry-leading growth rate, sharp improvement in operating margin and a strong deal pipeline.

After having seen exceptionally high growth rates, companies in this business are constantly on the lookout for acquisitions to grow, to deploy their excess cash and acquiring businesses to get access to technical capabilities and/or markets. With Mindtree, LTI may probably get both, with 50 percent of the former’s revenue accruing from digital.

LTI has a strong management that can add value to Mindtree and the latter's shareholders can look forward to benefits from synergies after the initial integration pangs. Moreover, the coming together of two successful mid-tier IT names will lead to a more efficient larger-sized IT company that can better navigate the challenges and grab opportunities thrown by the changing technological landscape. In the short term, should there be any management change because of LTI’s ownership, the regulator might insist on an open offer to minority shareholders.

Other options These benefits won’t be there if we have a simple transfer of stake to any financial investor such as a private equity firm. Mindtree’s promoters too may have reasons to feel uncomfortable with this development as the private equity investor can always offload the stake to a rival at a later date at a hefty premium. With no change in management, this wouldn’t call for an open offer and the near-term upside is limited to the valuation at which the deal takes place.

What if a white knight steps in? A white knight to help the founders is unlikely to pay top dollar for the stake. These investors typically like to monetise their investment within a relatively shorter time frame. To that extent, the near-term stock upside is limited and the question of an open offer doesn’t arise. But long-term investors should read this as a strong sign of confidence about the company’s future from the founders, who know the company best.

In nutshell, if the battle for ownership of a key investor’s stake in Mindtree doesn’t get too bitter, getting the management bogged down in the takeover battle and thus affecting performance, investors shouldn’t worry as its organic growth outlook appears strong.

Read | Mindtree Q3 review: Back on the growth path; buyAny takeover by a competent rival can add value. Also, stake monetisation at a premium to the current price sets a superior valuation benchmark. So, minority shareholders could well have the last laugh.

For more research articles, visit our Moneycontrol Research pageDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.