Neha Dave

Moneycontrol Research

Highlights:

-Robust loan growth, gaining market share at an accelerated pace

-Improvement in operating efficiency continues

- Muted growth in CASA desposits

-Impeccable asset quality, strong capitalisation

-Valuations reasonable given strong earnings visibility

---------------------------------------------------------

HDFC Bank, the largest and most profitable private sector bank, posted yet another quarter of strong performance with net profit increasing by 20 percent year- on -year backed by solid growth in loan book.

The bank has been the most consistent performer on the street for many years delivering earnings growth in high-teens. In fact, the predictability of its numbers make it at times almost boring to analyse. Its loan growth continues to be strong (ahead of the industry), margin is steady and asset quality remains as pristine as ever.

The bank posted robust profits through 1998 to 2018 with the compounded annual growth rate (CAGR) of 32 percent for 20 years. The bank's ROE (return on equity) has been more than 15 percent for every single year from 1998 to 2018. As a consequence of superior performance, the stock has generated compounded annual returns of more than 29 percent in last 20 years.

The stock's upward flight is now more than 20 years old. Hence, the moot question for investors is can the rally continue and wealth be created by investing in HDFC Bank stock today? Well, bull run in stocks don't die of old age and there is no sign of dearth in earnings growth for HDFC Bank.

With public sector banks saddled with huge NPAs and constrained by lack of sufficient capital, we expect HDFC Bank to strengthen its position in corporate lending by gaining market share from public sector banks while maintaining its leadership position in retail segment.

Key positives

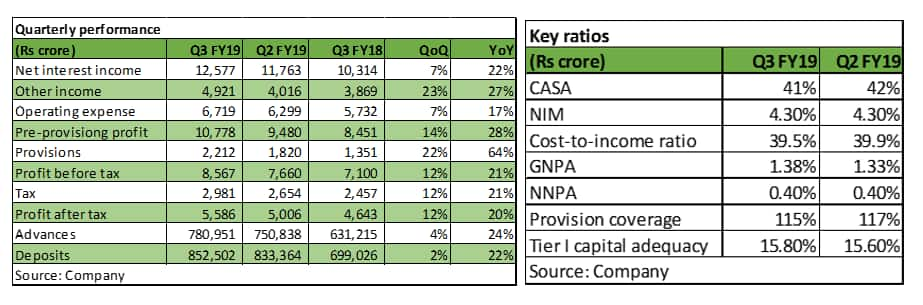

The bank reported total advances of Rs 780,951 crore as at end December, an increase of 24 percent over last year. Within the total advances, both domestic retail and corporate lending witnessed robust growth of 24 percent each. Its retails asset base now stands at 54 percent of total loan book (FY17: 51 percent; FY16: 48 percent) indicating bank is capturing retail market share at an accelerated pace. Its performance is commendable as it continues to grow its loan book at much ahead of system growth despite the higher base.

Strong loan growth coupled with stable net interest margins (NIM) enabled bank to post 22 percent increase in net interest income (NII).

Core fee and commission income was strong at 27 percent YoY and was underpinned by growth in payments and cash management business. This was accompanied by higher treasury gains. As a result, the headline non-interest income grew by 27 percent YoY.

Operating efficiency improved significantly as the core cost-to-income declined to 39.5 percent, as against 41.2 percent in Q3 last year led by controlled branch network growth and digital initiatives. Bank is benefiting from operating leverage as cost-to-income has declined to a new low in 10 years.

The growth in risk weighted assets (RWA) stood at 21 percent, below its overall advances growth indicating bank is efficiently utilising its capital. The bank’s capital adequacy at 17.3 percent stood well-above the regulatory requirement of 11.025 percent. Thanks to recent equity raise of Rs 23,590 crore which well equips the bank to take higher market share and accelerate earnings.

Key negatives

Gross non-performing assets (GNPAs) increased by 8 percent whereas NNPA increased 9 percent on a sequential basis. The rise in slippages was mostly from the agriculture book which has seen some stress in the last few quarters. Maintaining a conservative stance, bank utilised treasury gains to make contingent provisions of around Rs 300 crore as it anticipates slight spike in agriculture NPAs in future. However, the bank's floating provisions of Rs 1,451 crore and its more than adequate provision coverage ratio at 70 percent (115 percent including floating provisions) provides lot of comfort.

The growth in current and savings accounts (CASA) deposits was muted at 13 percent YoY while the growth in time deposits was much stronger at 29 percent YoY resulting in a slight dip in CASA ratio to 41 percent. Management alluded this as a deliberate strategy.

Other observations

There is a small uncertainty relating to impending CEO change in FY20. However, as the bank is process driven institution, we expect management transition to be smooth.

Since management doesn't comment on specific accounts, we aren't sure about the bank's exposure to IL&FS Group.

Valuation compelling given "significant moat"

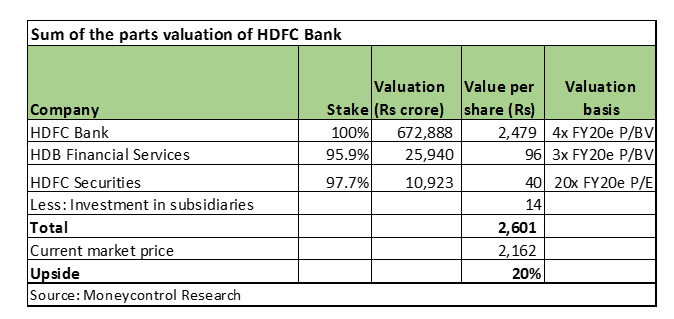

We expect the bank to continue to churn profitable growth over next few years as it enjoys dual moats (competitive advantage) on both assets as well as liabilities side. The equally strong performance of the bank's subsidiaries, HDB Financial Services and HDFC Securities, also lends comfort.

The stock currently trades FY20 P/B ratio (price -to-book) estimate of 3.4 which is below its long term historical range. As such, valuation looks reasonable.

We have used sum of parts valuation to arrive at fair value of the stock, which clearly is around 20 percent above the current market price. So far, the subsidiaries have aided bank’s earnings with dividends. Currently, they contribute around 5 percent to HDFC Bank's valuation but is expected to drive the valuation upwards in future as they gain further scale.

It is rarity to find a high quality business with decent and predictable earnings growth at reasonable valuations. With markets staring at multiple headwinds in the near-term, HDFC Bank is a must buy and should be investor's core holding.Follow @nehadave01

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!