The IRCTC IPO was a good one, a jewel from the government’s stable, that we had highly recommended subscribing to. However, the relatively small size of the issue (Rs 645 crore) combined with attractive pricing meant that the issue got oversubscribed by 112 times.

No wonder then that on listing, its shares gained by 128 per cent to close at Rs 728 on the first day. Most investors on the Street who missed the bus and may have wanted a slice of the post-listing action may have been left surprised by the sharp rally. The million dollar question now is: Should investors still attempt to board this ride or exercise caution and give it a pass?

While a straightforward answer is difficult, we would like to alert investors to certain moats that IRCTC enjoys. It is a unique company, combining four profitable businesses of railway catering, tourism, packaged drinking water and Internet ticketing.

What is more interesting is that in three of these business lines, namely, catering, online ticketing and packaged drinking water, it enjoys a monopoly, being the sole service provider to Indian Railways. Hence there is little risk to earnings. However, the steady state earnings in this space has been in high single digits.

Nevertheless, for IRCTC, quite a few earnings triggers will play out in the next couple of years.

Firstly, the Ministry of Railways had removed service charge on railway online bookings in 2016 has brought it back from September 1, 2019. The service charge on online booking at the rate of Rs 15 for Non-AC and Rs 30 for AC ticket (Rs 10 and Rs 20 for non-AC and AC classes if payments made through UPI/BHIM) has been reintroduced with no revenue sharing with the Ministry, unlike earlier.

IRCTC also has revenue sharing agreements with OTAs (online travel agents) who sell rail tickets using IRCTC’s platform. We see significant revenue and margin traction in second half of FY19 and first half of FY20 due to these changes.

Secondly, the company was constrained by capacity in the Rail Neer (packaged water) business. It is the only authorized entity by Ministry to manufacture and distribute packaged drinking water on all railway stations and trains. It could cater to only 45 per cent of the demand. This share should improve to 80% once the number of operational plants increases to 20 (by 2021) from the current 10. So we expect earnings growth far in excess of historic average on account of this.

We have factored these in our earnings estimates, and expect earnings to grow by 25 per cent CAGR (compounded annual growth rate) in the next couple of years. However, post FY21, earnings growth could normalise to low double-digits.

While in the IPO price of Rs 320, the company was extremely attractively valued at 12X FY21e earnings, the same appears to be waning post the rally.

Fair value of IRCTCIt would be interesting to look at the value of IRCTC’s individual businesses to arrive at a fair value of the stock.

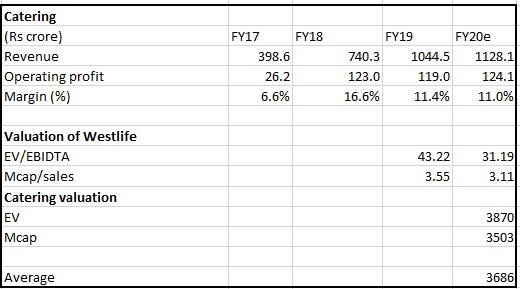

We have compared the catering business of IRCTC with a Quick Service Restaurant like Westlife Development that operates a chain of McDonald’s restaurants in west and south India. Using the same valuation multiple, we get the value of catering business for FY20e at Rs 3,686 crore.

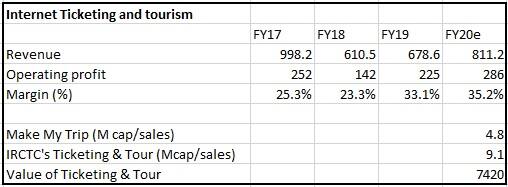

The internet ticketing and travel and tourism business of IRCTC resembles that of Nasdaq listed MakeMyTrip to a large extent. MakeMyTrip has a market capitalization of $2.359 bn with last reported yearly sales of $490 million and an operating loss of $150 million. It trades at price to sales multiple of 4.8x. Given the fact that IRCTC enjoys a monopoly and has revenue sharing with other OTAs and enjoys superlative margin in this business, we assign a multiple which is at 90 per cent premium to Make My Trip to arrive at a valuation of Rs 7420 crore.

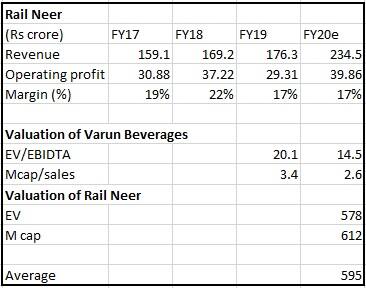

For the packaged drinking water business, in the absence of any listed packaged drinking water pure play like Bisleri, we have compared the business with the valuation multiple of a listed player Varun Beverages. It is the second largest franchisee in the world (outside US) of carbonated soft drinks and non-carbonated beverages sold under trademarks owned by PepsiCo.

Using the same valuation multiple as Varun Beverages, we get a FY20e valuation of this business at Rs 595 crore.

Now putting all the parts together gives us a fair value of IRCTC at Rs 11,702 crore on FY20e numbers, which is close to the prevailing market capitalisation, leaving little upside for investors at this stage.

Source: Moneycontrol Research

Does that mean there is no upside left?It would be wrong to conclude there is no long-term upside for IRCTC, although we believe that the near-term earnings triggers have been captured in the recent rally. IRCTC is an unique business with no comparable peers, no promoter issues (owned by the government) and little risk to earnings unless there is a change in policy. Hence it enjoys a “scarcity premium” which is difficult to quantify and may not get captured in our earnings-based sum of the parts (SOTP) valuation.

Finally, the company is entering new businesses as well. Since the company transacts payment of more than Rs 360 billion annually through bank and payment aggregators, in order to capitalize on this opportunity, it has implemented its own payment gateway platform named IRCTC e-wallet. It is developing IRCTC iMudra wallet and has launched i-pay payment gateway on a pilot basis.

IRCTC will also run trains as a part of government’s efforts to allow private operators to run train on select routes by paying a haulage charge to Railways. The operator will provide on-board services and will have the freedom of pricing the tickets. IRCTC has decided to run Tejas express on two routes of Delhi to Lucknow and Mumbai to Ahmedabad. The former has started operations shortly.

The potential upside from these initiatives have not been factored in the valuation yet and could be long-term drivers of earnings/valuation.

While we do not see an immediate upside, IRCTC should definitely be in the radar of long-term investors.

For more research articles, visit our Moneycontrol Research pageDisclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed hereDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.