Madhuchanda DeyMoneycontrol Research

IndusInd Bank delivered a 25 percent growth in profits for the December quarter. While core performance was tad softer as lending yields continued to dip and treasury gains were impacted by the sell-off in the bond market. Still, the management is confident about growth. The uptick in low cost deposits and high-yielding retail loan book remain the bright spots. Slippages were stable, and while NPA (non- performing assets) was marginally higher, there is no cause for alarm. However, the stock is not cheap at 3.7 times FY19 book. That means strong earnings growth will be the only trigger for the stock price to appreciate from these levels.

Quarter at a glance

Net interest income (difference between interest income and expenses) grew 20%, driven by a 25% growth in loans and a stable margin at 3.99%. Non-interest income growth was relatively muted despite 22% growth in core fees as treasury income declined.

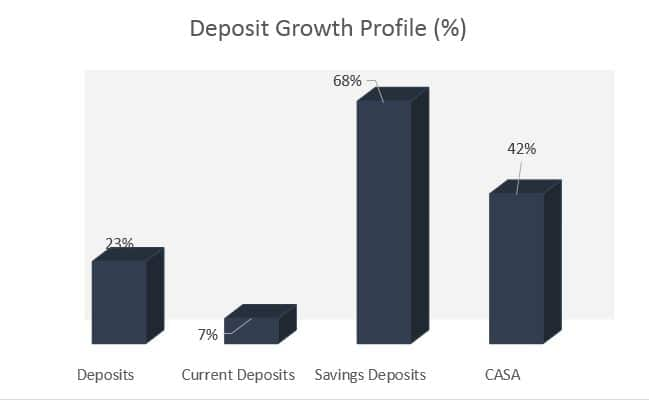

Strong traction in low cost deposits - The bank has been growing its low-cost deposit base at a healthy clip and the trend continued in this quarter as well. The growth in CASA (low cost current and savings account) has been much faster than overall deposits thereby taking CASA deposits to a respectable level of 42.9%.

Falling cost of funds partially counters the drop in yields – The bank has been experiencing pressure on yields both in corporate and retail lending. Still it has been able to maintain its margin, thanks to the strong low-cost deposit base.

Traction in retail book – The bank is witnessing good activity in the working capital market on the corporate side, as well as on the retail front. In fact, on a sequential basis, the growth in the retail book at 7% is much faster than the overall sequential loan growth of 4%.

The share of retail in the overall loan book has consequently improved a bit and the management is hopeful of an equal share of retail and corporate in the loan book going forward. This should help in maintaining margins as the yields on retail loans are higher.

Market share gains – IndusInd Bank is well-capitalised (Capital Adequacy Ratio 15.83%) and has gained market share in incremental business significantly in both loans and deposits. The bank’s market share in the incremental business of deposits and loans in the past one year stood at 6.5% and 3.3% respectively.

Asset quality not yet a worry –Slippages in the December was stable at Rs 408 crore (Rs 498 crore in the previous quarter) although lower recovery resulted in slightly higher gross NPA. Restructured advances at Rs 188 crore is only 0.15% of the book and the overall provision cover remains at a respectable 60%.

The bank seems to be executing a well charted out strategy with a focus on building a strong low-cost stable liability and high yielding assets. It is awaiting several regulatory approvals to formalize the Bharat Financial acquisition, and no negative surprises are expected on that front. However, the valuation at 3.7X FY19 book leaves little upside besides earnings growth.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!