Indian Hotels serves it hot for Q3 after rate recovery

February 05, 2020 / 17:39 IST

Highlights

- Healthy numbers in seasonally strong quarter

- ARR recovery drives growth in revenue

- Occupancy remains stable

- Demand-supply dynamics favourable- Strong growth likely in Q4, accumulate

------------------------------------------------------

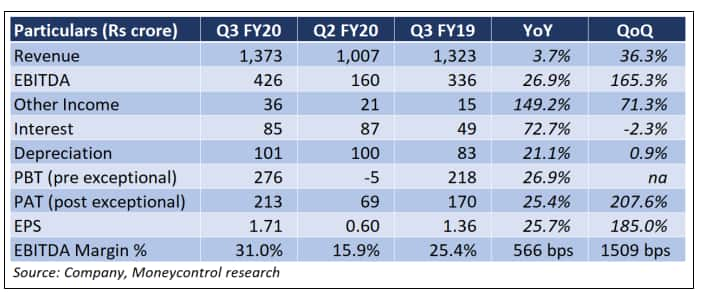

Indian Hotels Company Ltd (IHCL) (CMP: Rs 141; Mcap: Rs 16,857 crore), which runs the Taj chain of properties, gave a good account of itself for the December quarter. Its revenue and profits both rode on the back of expansion in margin.

The domestic segment put up a better show than its international operations. There are now signs of recovery in room rate growth, which is a positive for the company’s future growth.

We see Indian Hotels as a quality stock positioned to benefit from the ARR (Average Room Rate) recovery and the positive demand-supply gap in the industry. While the current price seems a bit expensive, we advise you to accumulate it on corrections.

The quarterly snapshot

- IHCL reported the best-ever performance in the last decade with a healthy growth in revenue, profits and margins. The growth in revenue was driven by a YoY growth of 5.2 percent in room rates and 1.5 percent in revenue from the food and beverage segments.

- On a sequential basis, revenue per available room (RevPAR) grew 5.6 percent, primarily aided by a recovery in the ARR, along with a decent growth on occupancy.

- Its international operations saw good traction in occupancy, which helped bring down the losses.

- The growth in profit got a helping hand from a reduction in the company’s costs, especially food and beverage expenses, along with addition of 855 rooms during October-December.

- A lower tax rate coupled with an uptick in other income boosted growth in net profit and net margin, which was up 242 basis points YoY.

- In line with the strategy of monetizing its non-core properties, the company sold off 18 residential flats, a land parcel in Pune, and 50 percent of the paid-up capital in Taj Madras Flight Kitchen Private in 9M FY20. This has resulted in a noticeable jump in other income during the quarter under review.

- IHCL added nine hotels during the first nine months of this fiscal, which kept it ahead of competition. The management reiterated the focus on opening at least one or more hotels per month.

- The revamping of the Ginger brand economy segment hotels is going as per schedule and the company expects nearly 50 percent of its properties to get a makeover by the end of FY20.

- The company continued to growth through the low risk management contract route. The management highlighted that currently 42 percent of the company’s properties are under the management contract model and the company aims to bring this to 50 percent in the coming year.

Major risks

The hotel industry is highly cyclical. While the dynamics is favouring IHCL currently, aggressive build-up in pipelines by most major hotel chains and the overall slowdown in the economy might pose a big challenge.

The current coronavirus spread is expected to bring about a slowdown in travel and trade, especially in South Asia. We believe that the slowdown in demand can hit revenue of the company in coming quarters. In case the viral outbreak intensifies, the downside risks could be higher.

Outlook

The second half of a financial year is generally stronger for the hospitality industry. In line with that trend, the company posted a robust performance.

With the turnaround in the international operations, expansion through the asset light management contract model and a growing domestic demand, we stay convinced about the growth story of the company. With the favourable demand-supply dynamics currently, we see strong growth to continue in Q4 and drive the year’s overall performance.

While we remain convinced about the company’s operational strength, at current prices we see the stock to be a tad expensive. We would recommend to accumulate on correction in the currently volatile markets.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!