Anubhav Sahu

Moneycontrol Research

Highlights:

- Revenue growth led by higher exports and better pricing

- Addition of Thionyl Chloride capacity aids vertical integration

- Stablising pricing, better product mix and retail exposure positive for margin

-------------------------------------------------

In its Q3 results, dyes major Bodal Chemicals posted a mixed set of earnings, where in margin was impacted due to product price deflation and high-cost raw material inventory.

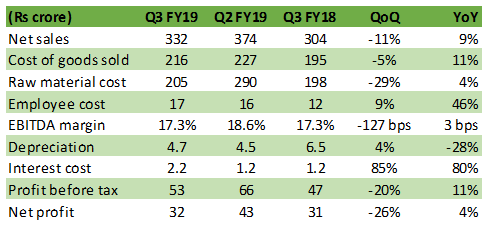

Standalone Q3 financials

Source: Company

Key positives

Sales improved nine percent year-on-year (YoY) led by higher pricing of dyes and dye intermediates compared to last year. Higher exports and better product mix were the key supportive factors. Sequentially, there has been a decline in the price of finished products.

Exports surged 78 percent and now constitute 47 percent of sales compared to 28 percent in Q3 FY18, which speaks volumes about its improving geographical reach.

On the capex front, during the quarter under review, company added thionyl chloride (TC) capacity of 36,000 tonne per year, which is a key step towards company’s backward and forward integration in the vinyl sulphone value chain. Commercial operations are expected to start by Q4 FY19-end.

In case of its joint venture for the water treatment chemical business - Trion Chemicals, the management expects improved near term performance. It’s noteworthy that the JV began operations in Q1 FY19. In Q3, Trion’s operations reached near about break even at the EBITDA level. This has been achieved due to softening input costs and stable finished goods prices. The company hopes to achieve break even at the net profit level within the next three-to-four months.

Key negatives

The key let down has been loss reported by its subsidiary, SPS Processors, which has been impacted by the lower H-acid (dye intermediate) prices.

Another setback has been on operating margin, where there was a sequential decline. Due to sudden decline in raw material and product prices, the company was not able to pass-through its high-cost raw material inventory purchased earlier.

Total production (46,798 tonne) remained flat on a YoY basis due to a plant shutdown during Q3. Dye production increased 3 percent on account of higher contribution from the new capacity commissioned last fiscal (12,000 tonne in March 2018). However, production of dye intermediates and basic chemicals declined.

Key observation: Moving towards a B2C model

The company is gradually moving towards B2C (business-to-consumer) model from a B2B (business-to-business) model. At presently, the company’s retail exposure (B2C) in the dyes business stands around 15-20 percent, which it intends to increase to 50 percent. This has positive implication for margin. It’s noteworthy that in the domestic market there has been a four times increase in direct retail sales in the last three years.

On account of this, the company has incorporated two subsidiaries -- Bodal Chemicals Trading Private incorporated in India and Bodal Chemicals Trading Company in China -- to reach clients directly. The idea is to have distributors and warehouses across the supply chain. The company is attempting similar arrangements in other regions as well.

According to the management, due to lower supplies from China in the global markets and higher cost of production in China on environment compliance, there is as an opportunity for Bodal.

Outlook

We are enthused about a couple of positive trends. Product mix is on an improving trend. Contribution of dyestuff sales has improved to 39 percent of sales in Q3 FY19 from 31 percent last year. Exports also command a higher share in topline (46 percent in 9M FY19 versus 28 percent last year) and this underscores the company’s reach in global market amid China supply reforms.

Ramp-up in utilisation of new capacity is noteworthy. Currently, overall capacity utilisation is near optimum at 80 percent. Dyestuff share is expected to improve, even more, as management is on track to increase dyestuff capacity by 6,000 tonne by Q1 FY20 (estimated cost: Rs 26 crore). It is noteworthy that this expansion would take the total dyestuff capacity to 35,000 tonne.

After the sharp volatility in petrochemicals in Q3, prices have stabilised. Overall we remain positive on the traction towards vertical integration. As the thionyl chloride capacity comes on stream and subsidiary business stabilises, we expect operating margin to be in the 18- 20 percent range in FY20. We reiterate that the ongoing environmental restrictions in both China and India is helpful in maintaining a favourable supply-demand dynamics for integrated players like Bodal, which is currently trading at 8.2 times estimated FY20 earnings.Follow @anubhavsays

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!