Sachin Pal

Moneycontrol Research

Highlights:

- Q3 volumes came in 15-16 percent higher

- Festive demand aided topline growth

- Price hikes eased crude-related cost pressures

- Upcoming elections resulting in near term demand uncertainty

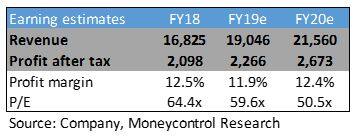

- Valuations rich at 50 times FY20 estimated earnings

-------------------------------------------------

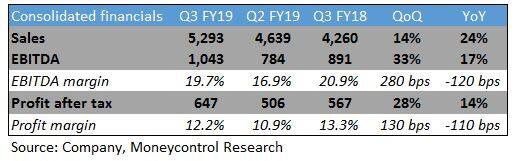

Asian Paints reported a strong set of earnings for Q3 FY19. Earnings were largely driven by higher topline, which was aided by strong double-digit volume growth and price hikes.

Result snapshot

Key positives

- The company reported a fourth successive quarter of double-digit volume growth on the back of a favourable base and strong consumer demand during the festive season. Volume growth was amplified by the timing of festive season (Diwali falling in November last year compared to October in the preceding year), which led to a shift in demand to Q3. Our estimate suggests that domestic decorative volumes increased by around 15-16 percent in the quarter gone by.

- Operating profit margin recovered sequentially on the back of successive price hikes, which alleviated some of the crude oil and currency-related cost pressures. However, operating margin fell on a yearly basis

- The domestic business continues to benefit from a healthy demand environment and majority of the segments (such as protective coatings, powder coatings, Sleek and Ess) reported strong quarterly performance

- Weakening crude prices (since September/October 2018) has alleviated some of the input cost pressures. This, along with the recent strengthening of the domestic currency, is expected to drive margin recovery in the near term

Key negatives

- The automotive business had a subdued quarter on the back of slowdown in its end-market. Sluggish automotive sales, mainly on account of the liquidity crisis in the NBFC space, is hampering paint demand from this sector. Outlook for this segment remains weak as the slowdown is expected to persist for at least 2-3 quarters

- The international business (10-12 percent of FY18 revenue) continues to face a challenging market environment due to multiple reasons such as availability of forex and weather seasonality

- The management in its post-earnings conference call highlighted uncertainty in the demand environment due to the upcoming general elections. Besides, global slowdown concerns can also impact GDP and industry growth

Other key developments

- Capacity expansion in Visakhapatnam (having 3 million KL per annum capacity) is on track and is expected to commence commercial production in Q4 FY19

- Capital expenditure for FY19 is estimated around Rs 1,000 crore. Capex should reduce going forward as the company is nearing commercialisation of its two new plants in Visakhapatnam and Mysuru.

OutlookThe stock commands a premium valuation on account of its market leadership position.

The stock is trading close to its lifetime high and is now valued close to 50 times FY20 earnings. While we have a positive view on the business and the sector, we maintain a cautious view on the stock as the current valuation factors in majority of the positives and offers limited upside from a near-term perspective.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!