Nitin AgrawalMoneycontrol Research

The bearing space appears promising on the back of secular growth in automobiles, uptick in the industrial segment and improvement in technology that would lead to increase in content per vehicle. Listed below are companies that are worthy of investor attention at the current juncture. We are inclined more towards smaller names like SNL Bearings, Menon Bearings and NRB Bearings. Among larger players, we are most comfortable with Schaeffler India.

SNL Bearings

We had initiated coverage on SNL Bearings, a needle bearings manufacturer that caters to automotive, original equipment manufacturers (OEM) and aftermarket segment.

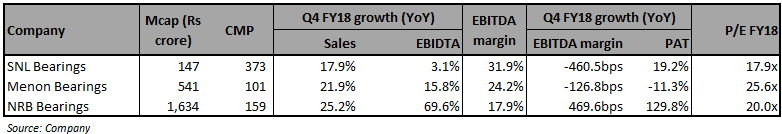

While the company posted a 17.9 percent year-on-year (YoY) growth in topline, its earnings before interest, depreciation, tax and amortisation (EBITDA) margin was marred by a significant rise in raw material (RM) prices and contracted 460.5 basis points YoY. Its EBITDA margin continues to be the highest among all players. Profit after tax (PAT) grew 17.7 percent YoY.

We continue to remain confident on the back of strong industry tailwinds and financials. The stock is also trading at a significant discount compared to its peers.

Menon Bearings

Menon Bearings (MBL) is a manufacturer of bi-metal engine bearings, bushes and thrust washers for light and heavy automobile engines, two-wheeler engines as well as compressors for refrigerators, air conditioners etc.

Riding well on the growth in the commercial vehicle (CV) segment, the company posted a 21.9 percent YoY growth in revenue. EBITDA margin was impacted by a rise in RM prices, the impact of which was offset by a reduction in operating and manufacturing expenses. EBITDA margin stood at 24.2 percent, the second-highest among all players. PAT declined 11.3 percent YoY due to higher tax outlay.

The management plans to increase its bearings capacity by 30-35 percent over the next 1 year to meet rising demand accruing from the CV segment. This coupled with strong financials and reasonable valuations beckon investor attention.

NRB Bearings

NRB Bearings (NRB) is the largest needle roller bearing manufacturer in India with segmental market share of around 70 percent.

Net operating income grew 25.2 percent YoY, led by strong growth in demand for passenger vehicles (PV) and CVs. EBITDA rose 69.6 percent YoY and margin expanded 469.6 bps on the back of operating leverage and favourable product mix towards CVs. Strong operating performance and higher other income led NRB to report a 129.8 percent YoY growth in PAT.

Presence in all automobile segments, which are expected to report robust growth, coupled with the management’s target of increasing the market share in aftermarket provides us comfort. The stock is also trading at reasonable valuation of 20 times FY18 earnings.

SKF India

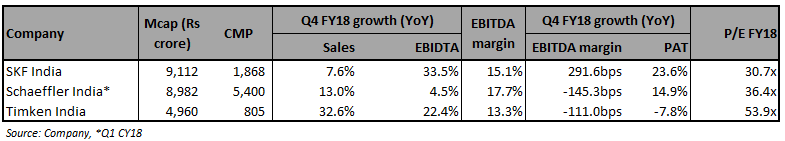

SKF India’s (SKF) sales grew 7.6 percent YoY. EBITDA witnessed a significant growth of 33.5 percent on the back of a favourable mix. EBITDA margin expanded 291.6 bps to its lifetime high of 23.6 percent due to higher contribution from traded goods.

However, the management indicated that these margins cannot be sustained and would normalise going forward. It said industrial sales were bad during Q4 on the back of poor wind sales. Growth in the PV segment has peaked, whereas it expects other segments to continue to do well. Moreover, it sees strong growth from railways.

The stock currently trades at 30.7 times FY18 earnings, which is above our comfort level.

Schaeffler India

Schaeffler India’s net sales grew 13 percent YoY on the back of growth accruing from the domestic automotive original equipment (26 percent YoY) and industrial segments (14 percent YoY), respectively.

In terms of revenue contribution, automotive contributed 19 percent and industrials 81 percent to total sales. On a pro-forma basis, the combined entity (includes LuK India and INA Bearings) witnessed a YoY growth of 16.5 percent driven by Luk which posted a 30.2 percent YoY growth in revenue.

EBITDA margin contracted 145 bps YoY primarily due to rise in RM prices. The management said there is always a time lag of 3-6 months in passing on the rise in RM prices. The company has undertaken a price hike of 4 percent across all products effective April 1, which should help margin recover going forward.

With strong growth accruing in industrial and automotive segments, strong product portfolio, addition of new products, capacity expansion plans and completion of the merger with LuK and INA, the company deserves attention. The stock is currently trading at 36.4 times FY18 earnings: the second highest among all players.

Timken India

Timken India is a market leader in tapered roller bearings and is the only indigenous manufacturer of freight application bearings for railways.

Net sales and EBITDA grew 32.6 percent and 22.4 percent YoY, respectively. EBITDA margin, however, contracted 111 bps due to a significant rise in RM prices.

The stock is currently richly valued – highest among all players - which leaves us without much comfort.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!