Electric vehicle was clearly the buzzword of the automobile industry in 2017. Not to be seen lagging behind, the government of India has set an ambitious target of having all vehicles on roads to be electrics by 2030. This plan envisages a transition that could have huge ramifications for a large number of companies catering to the automobile ecosystem.

The change of this magnitude would have many winners and losers and investors got to be prepared to ride the age of EVs or the age without ICE (internal combustion engine) carefully. Since the Indian market has a large play on auto ancillaries, we decided to create a portfolio of ancillary companies that are immune to EV disruption and/or beneficiaries of the advent of EV.

Why the EV immune portfolio within auto component segment? As per ACMA (Automotive Component Manufacturers Association of India), India’s auto-component industry’s turnover was pegged at USD 39 billion in 2015-16 and contributed 2.3 percent of GDP, a significant contribution.

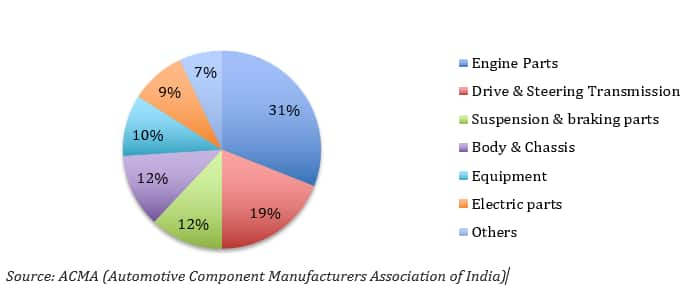

In terms of segments, the contribution of engine parts to total production is the highest followed by drive and steering transmission components. Engine parts and drive transmission are the segments, which would be impacted negatively by the introduction of EVs as the focus would shift from engine management, fuel efficiency, emission control to batteries and drive motors.

Hence, at this stage of transition, investors got to pick their bets carefully. We have assigned weights of the companies in the portfolio based on the valuation comfort and the growth outlook. The weighted average market cap of this portfolio is Rs 14,417 crore.

Portfolio stocksMinda CorpThe company has a well-diversified product portfolio ranging from security systems, wiring harnesses, couplers & terminals etc. that caters to all major two, three, four wheeler & off-road vehicle manufacturers in India & overseas.

It has recently acquired EI Labs that underscores its focus towards R&D and EVs. In the second quarter, EI Labs bagged a prestigious order from EESL to supply mobility components for EVs.

With marquee clients in its kitty, no client concentration, focus on research and development and turnaround at Minda Furukawa, the company beckons the attention of investors. Reasonable valuations also lend us comfort.

Lumax IndustriesLumax has a major presence in the end-to-end lighting solutions that cater to all major two-wheelers, commercial and passenger vehicles manufacturers in India and overseas. The company has a leadership position in the space with 60 percent market share.

Lumax’s products are unaffected by the EV disruption as EVs would require the vehicles to be more energy efficient, which would lead to the faster adoption of LEDs.

Market leadership, marquee clients in its kitty, its focus on developing technologically advanced products and adoption of LED-based products provide an improved earnings visibility for the company and, therefore, merits investors’ attention.

Motherson SumiMotherson Sumi Systems is India’s largest automotive wiring harness company and one of the largest auto ancillary companies.

As per the management, EVs would need more wiring component which would increase the content per vehicle by close to 10-20 percent. Other businesses related to polymer and mirror-based products would also not be affected because of the shift to EVs.

The new plants that are getting commissioned should result in increasing contribution. This, coupled with the push towards EVs, should result in healthy growth in the topline and gradual increase in margins. MSSL is currently trading at reasonable valuations which warrants investors’ attention.

Jamna AutoJamna Auto Industries (JAI) is the largest manufacturer of Tapered Leaf and Parabolic Springs for CVs in India. The company supplies its products to major OEMs (original equipment manufacturers) in India and has 70 percent domestic market share.

Market leadership, a strong uptick in CVs, marquee clientele, operating leverage, reduced debt and strong financial performance should support earnings, going forward. The business remains unaffected by EV disruption and trades at reasonable valuations that beckons investor’s attention.

Bharat ForgeBharat Forge Limited (BFL) is a technology-driven metal forging company having a transcontinental presence.

In addition to its products being largely unaffected by EVs, the company has already started working on its R&D division to work towards new requirements coming in from electric vehicles.

The positive outlook for industrials and Class 8 truck demand in US and multiple growth avenues coupled with new opportunities from EVs make it an ideal investment call, although the rich valuation tempers our excitement that is reflected in the lower weight at this point in time.

Ramkrishna ForgingsRamkrishna Forging (RMKF) is the second‐largest forgings player in India with a total capacity of 150,000 tonnes. It is a manufacturer of open and closed die forgings of carbon and alloy steel, micro alloy steel and stainless steel forgings.

With all domestic regulatory headwinds waning in auto sector and pickup in demand for Class 8 Trucks in North American (NA) market, RMKF is in a sweet spot as is also evident from the strong set of numbers posted by the company for 2QFY18. With the new press line, new products, increase in the market share, revival in Class 8 trucks demand in NA, the company beckons investors’ attention.

Gabriel IndiaGabriel India Limited is the flagship company of ANAND group, which provides the widest range of ride control products in India, including shock absorbers, struts, and front forks, across every automotive segment.

With marquee clients in its kitty, diversified customer base, improving product mix towards passenger vehicles, focus on high margin after-market segment and export markets, and no impact of EVs makes it looks like a well shielded candidate in the post EV era too.

PPAP AutomotivePPAP Automotive is a complete solution provider for automotive sealing systems in ploymers as well as, EPDM (Ethylene Propylene Diene Monomer (M-class) rubber - a type of synthetic rubber which is an elastomer) and a complete range of Injection Moulded Interior and Exterior products. The company garners most of its revenues from Maruti and Honda Motors.

The company is worth investing in on the back of three upcoming manufacturing facilities, expansion by Maruti, robust product portfolio with a strong brand, focus on R&D and technical partnership with international players.

Munjal ShowaThe company is a result of collaboration between Hero Group and Japan’s Showa Corporation. It manufactures shock absorbers such as Front fork and Front/Rear cushion for 2-wheelers and Struts for passenger cars with most of the revenue coming from 2- wheelers segment. Two-wheeler manufacturer Hero MotoCorp, Honda and Yamaha contribute to around 85 percent of the revenues and the remaining comes from PVs segment where Maruti is its client.

The company is riding on the growth coming in from 2W segment on the back of improved rural sentiments, pay revisions of government employees and new product launches. The company’s products are not impacted by the ransition to EV. This coupled with reasonable valuations warrants investors’ attention.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!